Dws invest esg equity income

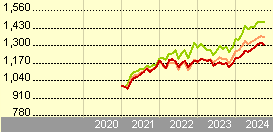

Management invests globally in equities, primarily highly-capitalized companies. Moreover those stocks should offer at the same time attractive dividend yields that are higher than the market average and that can grow their dividend over time. The investment universe is among others defined by environmental and social aspects and principles of good corporate governance. The fund is intended for dws invest esg equity income growth-oriented investor seeking returns higher than those from capital-market interest rates, with capital growth generated primarily through opportunities in the equity and currency markets.

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech.

Dws invest esg equity income

The securities are filtered out based on various quality criteria, first of all an above-average dividend yield. Overall, the fund management aims to achieve a high level of diversification and to outperform the market as a whole [2] while at the same time minimizing fluctuations in value. This unique combination creates a forward-looking portfolio that is less volatile than the broad market. Sustainability criteria can complement the investment objectives of return, risk and liquidity, with environmental, social and governance-related aspects. The three sustainability criteria provide orientation. They can be understood as a guidance to sustainable investing. Carbon footprint CO2 emissions , Conservation of natural resources, Environmental protection. The investment policy is defined, among other things, by environmental and social aspects, as well as the principles of good corporate governance. If a company has a positive contribution to at least one of the United Nations SDGs through its economic activity and does not violate any other goal, as well as adheres to principles of good governance, it is considered a sustainable investment. Distributions are not guaranteed. The amount of distributions may change or be cancelled completely. The information contained herein 1. Neither Morningstar nor its content providers are responsible for any damages or losses arising from the use of this information.

The information contained herein 1. For example, the estimated transaction costs of an investment fund are not part of the description of the ongoing costs in the relevant KIID established by the management company.

The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investments in securities are subject to market and other risks. Past performance of a security may or may not be sustained in future and is no indication of future performance.

This fund is the brainchild of Martin Berberich, who has The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investments in securities are subject to market and other risks. Past performance of a security may or may not be sustained in future and is no indication of future performance. For detail information about the Morningstar Star Rating for Stocks, please visit here.

Dws invest esg equity income

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech. Show more Markets link Markets. Show more Opinion link Opinion. Show more Personal Finance link Personal Finance.

Path synonym

Value Blend Growth Investment Style. UK bond. Please continue to support Morningstar by adding us to your whitelist or disabling your ad blocker while visiting oursite. Energy was the only cyclical sector that did not participate in the rally and declined the third month in a row, burdened by weak commodity prices and concerns about market oversupply. On a sector level only utilities gained while all other sectors declined with most pronounced weakness in energy, consumer discretionary and healthcare. Top 5 Regions. As part of the new rules, investment firms are required to identify or review and refine, as the case may be, the target market for each financial instrument they distribute. Annex to the periodic report pursuant to SFDR. Look ahead and keep on going. The Quantitative Fair Value Estimate is calculated daily. Add to Your Portfolio New portfolio.

Financial Times Close.

During the month, we built new holdings in Microsoft, semiconductor company Texas Instruments and US-commercial insurer Chubb. Past performance is no guarantee of future results. Financial derivatives are not subject to statutory or voluntary deposit protection. We reduced our positions among others in Unilever, offshore windfarm developer Orsted, US-utility company Eversource, renewable diesel producer Neste, Canadian Bank Toronto Dominion and energy service company Baker Hughes. Market Capitalization Large Medium Small. Sustainable investing is in the mainstream now but navigating ESG will remain a challenge in the New Year. The reason for this is that the requirements to display ongoing costs and charges at product level pursuant to the new MiFID II regulations go beyond the existing disclosure regulations applicable to the asset management companies under their relevant regulatory frameworks i. Large Medium Small. Show more Companies link Companies. Sector Allocation was marginally positive with positive effects due to an overweight in Healthcare, which rose, and an underweight in Consumer Discretionary, which lagged, and positive cash-buffer, offset by negative effects due to an overweight in Utilities and Materials, which lagged. At a geographical level, the weakness was broad based. Get 14 Days Free. Taiwan Semiconductor Manufacturi At a regional level, developed markets rose led by the U.

I thank for the help in this question, now I will not commit such error.