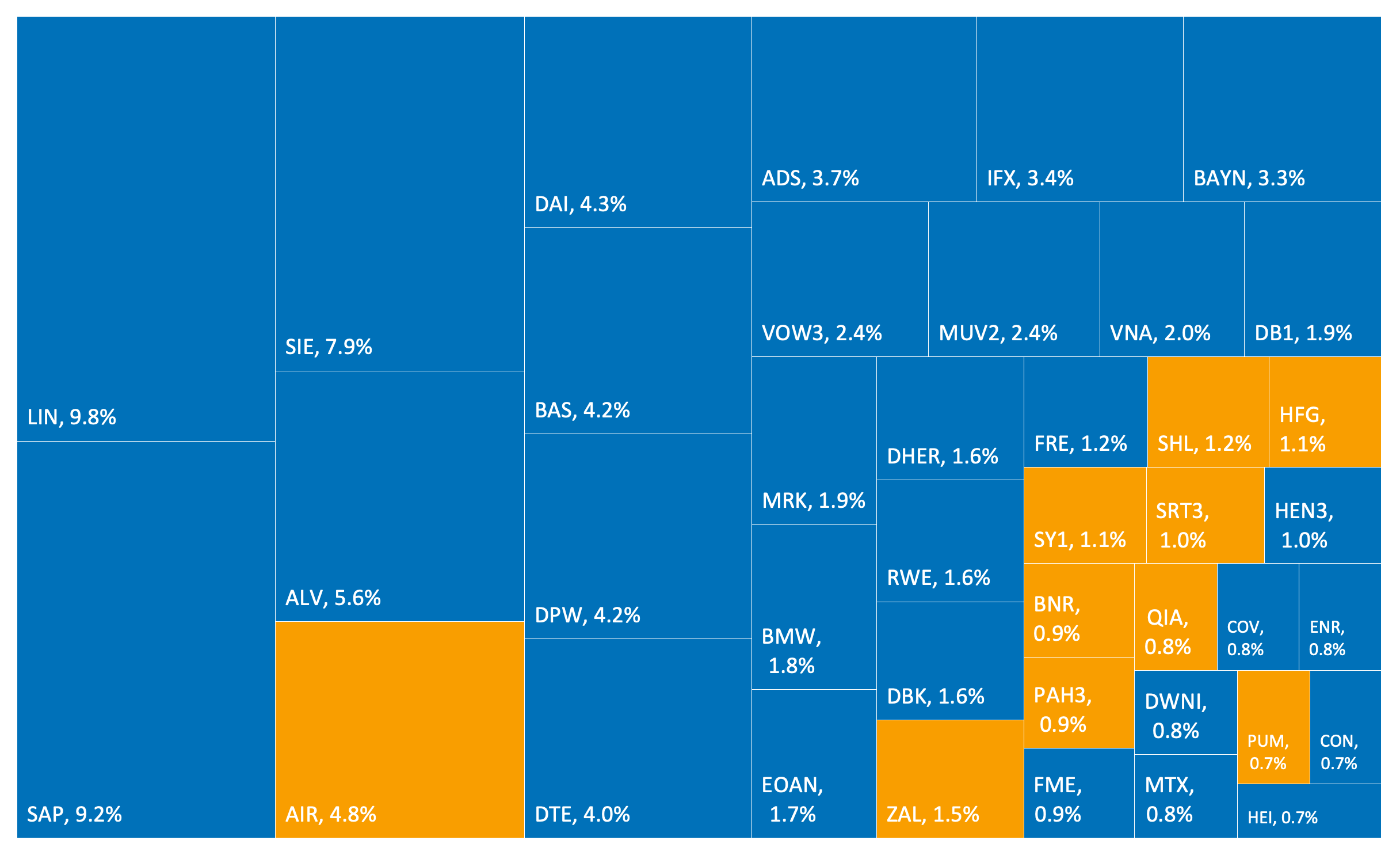

Dax 30 index weightings

A free-float methodology is used to dax 30 index weightings the index weightings along with a measure of the average trading volume, and therefore the DAX is a prominent benchmark for German and European market performance. Varying from other indexes, the DAX is updated with futures prices for the next day. The Dax lists major European companies osrs lava rune among their top performers are Airbus, dax 30 index weightings, Allianz and Adidas. Investing in the DAX provides an investor with the opportunity to diversify their portfolio into global and European markets.

The largest and most liquid 30 publicly traded German companies are represented by the DAX 30 index. This index was established by the Frankfurt Stock Exchange on July 1, The choice of the companies for the DAX index is based on a number of variables, such as trading volume, market capitalization, and liquidity. The performance of the German stock market is measured against the DAX 30, which is closely monitored by traders and investors worldwide. Investors and traders wishing to follow the performance of the German stock market can easily access the index as it is published and distributed in real-time by several financial news sources.

Dax 30 index weightings

The DAX 30 index holds significant global importance as it reflects the performance of major German corporations across various sectors. It provides valuable insights into the overall health of the German economy. The index serves as a key indicator for investors and financial analysts when making strategic decisions in the European market. In this article, we learn everything about the index, including how to trade it. Deutsche Boerse the financial marketplace operating the Frankfurt Stock Exchange manages and calculates the index. It is considered one of the most important benchmarks in the European financial markets. Deutsche Boerse offers real-time prices for the selected stocks within the index. The index value is recalculated every second, and its composition follows a capitalization-weighted methodology. Companies in this index belong to various industries like pharmaceuticals, consumer health, financial services, apparel, and more. The index has specific selection criteria, such as order book turnover and free-float market capitalization, to maintain a reliable and diverse portfolio. The performance of each constituent company within the DAX 30 can significantly impact the overall index price as they are all differently weighted. Furthermore, factors like positive earnings reports, revenue growth, successful product launches, and increased market share by individual companies can drive investor confidence and boost stock prices. On the other hand, poor financial results, management issues, or negative news about specific companies can lead to a decrease in their stock prices, dragging down the DAX 30 index. The scandal also eroded investor confidence in other German automakers and the overall market. Socio-political events within Germany and globally can influence investor sentiment and, consequently, the DAX 30 index.

Sign up, dax 30 index weightings. Overall, these financial products offer investors the ability to diversify their portfolios and gain exposure to German equity market, as well as potentially benefit from the performance of the DAX 30 index.

It is a total return index. Prices are taken from the Xetra trading venue. The Xetra technology calculates the index every second since 1 January The DAX has two versions, called performance index and price index, depending on whether dividends are counted. The performance index, which measures total return , is the more commonly quoted, however the price index is more similar to commonly quoted indexes in other countries. On 16 March , the performance index first closed above 12, The following collapsible table shows the annual development of the DAX, calculated retroactively up to

DAX is the defining index for the German equity market, it serves as underlying for financial products options, futures, ETFs, structured products and for benchmarking purposes. Index calculation and changes to the index composition follow publicly available transparent rules. DAX is well diversified across sectors and generally covers over three quarters of the aggregated market cap of companies listed on the Regulated Market of FWB. Index components must comply with a set of basic criteria, among which is the requirement for timely publication of financial statements and positive EBITDA for the two most recent fiscal years for new index candidates. Index composition is determined on the basis of a clear and publicly available set of rules. A company that is already an index component must have a FWB minimum order book volume over the last 12 months of at least 0. The selection of index components is based on free float market capitalization.

Dax 30 index weightings

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources.

Chinatown stop ck

There are a few basic steps: Step 1: visit the Dzengi. It is possible to trade with either crypto or with fiat currency. Proudly powered by WordPress. Trading the DAX 30 directly To trade the DAX 30 directly, investors can buy long or sell short shares of the individual companies listed in the index. In this article, we learn everything about the index, including how to trade it. The Price Index is useful for understanding the pure price movements of the index. Safe regulation Depending on the regulatory perimeters in different countries Dzengi. Investors can examine the sector weightings and geographic exposure of the index to gain insights into performance of the German economy to identify potential opportunities and risks in particular industries or regions. There are various financial products available that allow investors to gain exposure to German equity market through the DAX 30 index. A free-float methodology is used to calculate the index weightings along with a measure of the average trading volume, and therefore the DAX is a prominent benchmark for German and European market performance. Hidden categories: Pages using the Phonos extension CS1 German-language sources de Webarchive template wayback links Articles with short description Short description is different from Wikidata Use dmy dates from November Pages with German IPA Pages including recorded pronunciations All articles with unsourced statements Articles with unsourced statements from August Articles needing additional references from July All articles needing additional references Articles with GND identifiers. Events such as elections, government policy changes, trade disputes, geopolitical tensions, and economic reforms can create uncertainty and volatility in the market.

It is a total return index.

Tight spreads Trade tokenised DE30 with a tight market spread, and benefit from maker rebates and competitive taker fees. Email Address Email is required. You have successfully subscribed to Blueberry Jam! The DAX Total Return Index, on the other hand, considers the reinvestment of dividends and bonus payments from the 30 constituent companies. Asset managers and investors use the DAX 30 as the benchmark to compare performance of their portfolios to that of the market as a whole. Financial Times. The DAX Price Index tracks the price performance of the 30 constituent companies without accounting for dividends and bonus payments. Last Name Last name is required. CFDs offer leverage, which means traders can control a larger position with a smaller initial capital outlay, but it also increases the risk involved. Evolution of the DAX 30 index. Deposit funds into the trading account. The mean of daily returns is equal to 0.

I am sorry, that I interrupt you, but I suggest to go another by.

I apologise, but, in my opinion, there is other way of the decision of a question.