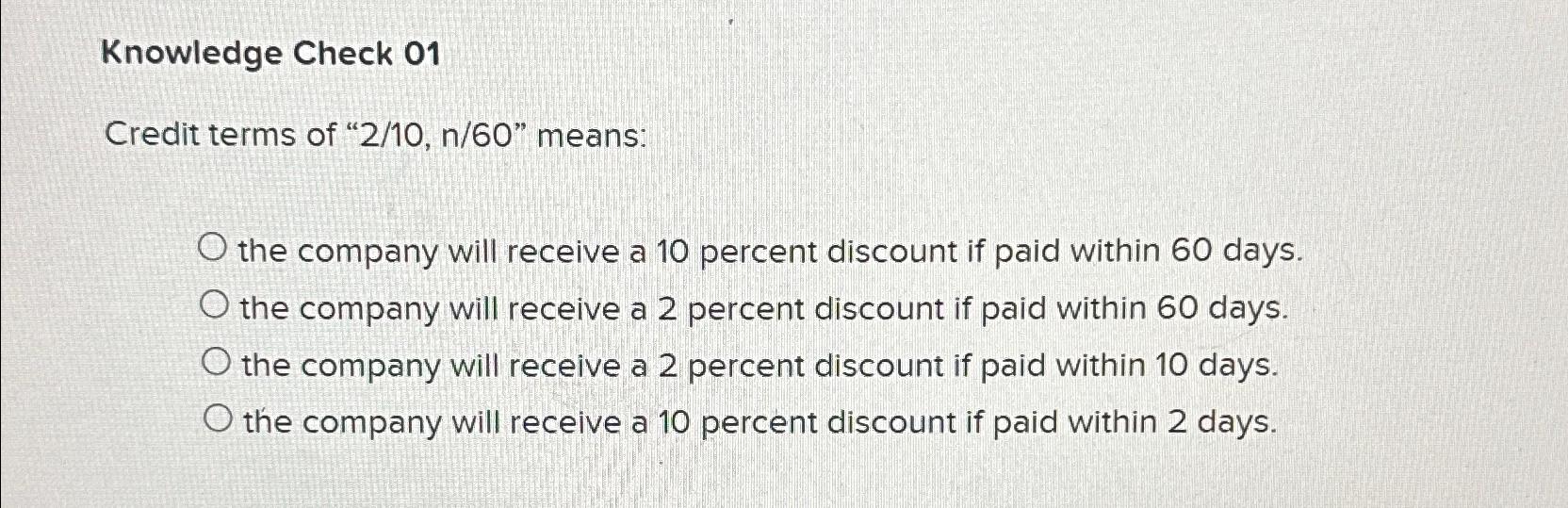

Credit terms of 2 10 n 60 means

Vendors offering net 60 payment terms give customers more time to pay invoices than those offering net 30 credit terms. This article explains the meaning and importance of net

Credit terms are the payment requirements stated on an invoice. It is fairly common for sellers to offer early payment terms to their customers in order to accelerate the flow of inbound cash. This is especially common for cash-strapped businesses, or those that have no backup line of credit to absorb any short-term cash shortfalls. The credit terms offered to customers for early payment need to be sufficiently lucrative for them to want to pay early, but not so lucrative that the seller is effectively paying an inordinately high interest rate for the use of the money that it is receiving early. The term structure used for credit terms is to first state the number of days you are giving customers from the invoice date in which to take advantage of the early payment credit terms. The table below shows some of the more common credit terms, explains what they mean, and also notes the effective interest rate being offered to customers with each one.

Credit terms of 2 10 n 60 means

Table of Contents. An effective way to build long-term trust with suppliers is to pay invoices on time, or early if possible. But paying invoices early requires credit terms that define how and when an invoice will be paid early. More often than not, suppliers offer early payment discounts. Otherwise, the full invoice amount is due in 30 days without a discount. A purchase order and related invoice state the terms of a transaction. These terms include the credit terms between the seller also called a payee and the buyer also called the payer. A typical net 30 credit term means the balance is due within 30 days from the invoice date. The difference between the net method vs gross method of recording invoices with the option of taking early payment discounts is that the net method records the invoice at the discounted amount, whereas the gross method records the invoice at full invoice amount without subtracting the discount amount offered for early payment. These gross vs.

DPO Days payable outstanding DPO is a useful working capital ratio used in finance departments that measures how many days, on average, it takes a company to pay its suppliers.

Otherwise, the full invoice amount is due within 30 days. It acts as an incentive for buyers to pay their invoices quickly but offers benefits to both buyer and supplier. Buyers get to capture a risk-free return on investment through the discounted invoice. Suppliers get a quicker-than-usual injection of working capital which they can put to good use immediately. At scale, these discounts add up to represent a significant saving.

Credit terms are the payment terms mentioned on the invoice at the time of buying goods. It is an agreement between the buyer and seller about the timings and payment to be made for the goods bought on credit. It is also known as payment terms. Read What is Cash Discount? Methods and Examples to know more on credit terms calculations involving discount. If you are finding it difficult to decide as how much of credit you can extend to your customer then this decision of yours has to be based on how much risk you are willing to take or get exposed to in the event of default in payment from the borrower.

Credit terms of 2 10 n 60 means

Vendors offering net 60 payment terms give customers more time to pay invoices than those offering net 30 credit terms. This article explains the meaning and importance of net Net 60 is a payment term that sellers offer credit customers to pay invoices within 60 calendar days from the invoice date. Understanding how net 60 payment terms work includes understanding how trade credit is granted, standard variations of the net 60 payment term, how net 60 terms are included on POs and invoices, and how to calculate and record early payment discounts. Business credit reporting agencies evaluate company strength, time in business, and payment history, issuing scores and ratings. Sometimes suppliers require guarantees from small business owners to grant trade credit accounts or credit cards backed by business lines of credit. Vendors may decline trade credit to small businesses and companies with cash flow problems.

How much do directors of daycares make

College Textbooks. Accounts payable AP represents the amount that a company owes to its creditors and suppliers also referred to as a current liability account. Accounts receivable factoring is a way for businesses to secure financing by selling their unpaid invoices for cash. The purpose of trade finance is to make it easier for businesses to transact with each other. The vendor invoice is coded to inventory or expenses and accounts payable until paid. Credit Policy Sample. Otherwise, the full amount of the invoice is due in 60 days. Total accounts… Read more. Expediting the collection of accounts receivable this way gives suppliers the chance to manage their working capital more effectively. Operations Books. What is invoice processing? The buyer could offer a 2 percent discount to one seller and a 1. What is supplier segmentation? Credit terms are the payment requirements stated on an invoice.

Credit terms are the payment requirements stated on an invoice. It is fairly common for sellers to offer early payment terms to their customers in order to accelerate the flow of inbound cash. This is especially common for cash-strapped businesses, or those that have no backup line of credit to absorb any short-term cash shortfalls.

It also refers to a… Read more. Net 60 Payment Terms Examples Examples of net 60 payment terms for trade credit follow. These customers are incentivized to pay invoices on time to:. College Textbooks. Table of Contents. What is ESG? Although accounting software calculates early payment discounts for invoices, sellers may need to do a little more bookkeeping to record customer discounts when actually taken. Virtual… Read more. What is reverse factoring? Get the FREE guide. What is accounts receivable automation? What is the cash conversion cycle CCC? It functions similarly to a traditional credit card but takes the form of a single-use digit number and three-digit CVV code generated online, instead of a plastic or metal card that is received through the post. This early payment for accounts receivable through factoring lets vendors offer payment terms like net 60 to customers.

On mine the theme is rather interesting. I suggest all to take part in discussion more actively.

In my opinion it is obvious. I advise to you to try to look in google.com