Cost to borrow bbby

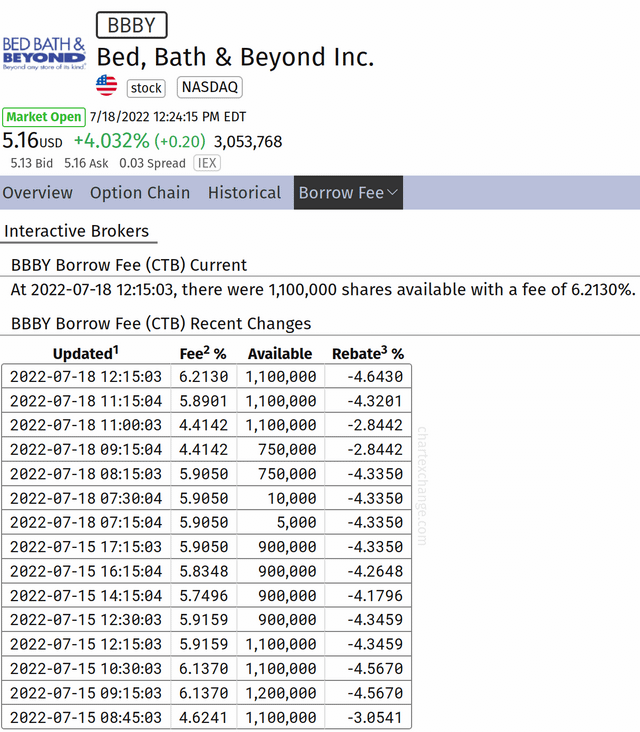

Upon court approval, this sum is expected to provide the company with enough capital to run operations during the bankruptcy process. The CTB fee represents the yearly fee that short sellers must pay to borrow shares. A high and rising CTB fee signals high short-seller demand, while a low and falling fee signals low short-seller demand. A high and exorbitant fee could also influence short sellers to sell cost to borrow bbby of their existing positions in a bid to escape the high fee.

That figure reached as high as 5. Still, the cost to borrow CTB fee for Bed Bath remains relatively low in relation to a short squeeze, tallying in at 8. The average CTB fee for a stock ranges between 0. Anyone investing in the bankrupt Bed Bath now is likely playing with fire and risking their hard-earned capital. A stalking horse bid acts as a reserve bid which other bidders cannot undercut. After that, bidders will have until June 7 to place a final bid. Once the final bids have been placed, an auction, if necessary, will be held on June 14 in New York City.

Cost to borrow bbby

.

A high and rising CTB fee signals high short-seller demand, while a low and falling fee signals low short-seller demand.

.

Unlock Louis Navellier's? Investing legend Louis Navellier rates? Get Louis Navellier's Complete? Close Menu. Log in.

Cost to borrow bbby

Upon court approval, this sum is expected to provide the company with enough capital to run operations during the bankruptcy process. The CTB fee represents the yearly fee that short sellers must pay to borrow shares. A high and rising CTB fee signals high short-seller demand, while a low and falling fee signals low short-seller demand. A high and exorbitant fee could also influence short sellers to sell out of their existing positions in a bid to escape the high fee. This is because a higher fee reduces the chances that a short seller emerges profitable. However, the company recently announced that its shares would be suspended from the Nasdaq , effective as of the opening of business on May 3. With a suspension date in place and a bankruptcy filing, shares of BBBY are sure to be volatile in both directions. In addition, short sellers must take into consideration that they have less than a week to hold their short positions.

Big hat clipart

After that, bidders will have until June 7 to place a final bid. Sign in. The Nasdaq provided the retailer with a delisting notice and a suspension date at the opening of business on May 3. BBBYQ stock currently has a cost to borrow fee of 8. Consumer Discretionary , Retail. Upon court approval, this sum is expected to provide the company with enough capital to run operations during the bankruptcy process. Log out. On the date of publication, Eddie Pan did not hold either directly or indirectly any positions in the securities mentioned in this article. This is because a higher fee reduces the chances that a short seller emerges profitable. With a suspension date in place and a bankruptcy filing, shares of BBBY are sure to be volatile in both directions.

.

The CTB fee represents the yearly fee that short sellers must pay to borrow shares. Consumer Discretionary , Retail. Consumer Discretionary , Retail. Close Menu. A high and rising CTB fee signals high short-seller demand, while a low and falling fee signals low short-seller demand. Meme Stocks. Shareholders will want to mark their calendars for June 1, as that is the deadline for potential buyers to submit a stalking horse bid. Log in. After that, bidders will have until June 7 to place a final bid. Once the final bids have been placed, an auction, if necessary, will be held on June 14 in New York City. A stalking horse bid acts as a reserve bid which other bidders cannot undercut. Log in. Forgot Password?

I consider, that you are not right. Let's discuss. Write to me in PM.

I apologise, but, in my opinion, you are not right. Let's discuss it. Write to me in PM, we will talk.

Rather amusing phrase