Cost of ufile

Post by NormR » 17Nov Post by snowback96 » 18Nov Post by ole'trader » 18Nov Post by snowback96 » 19Nov

Are you a post-secondary student? Is yours a simple return? Are you filing a Federal tax return for the first time? You must be a resident of Canada, have tuition fees and have attended school for at least one month during the tax year being prepared. Tuition credits that are not used or transferred to a supporting person in the current year will be carried forward by UFile for future use by the student. You must also be entitled only to standard non-refundable tax credits, and have no other deductions or credits such as RRSPs, charitable donations or medical expenses.

Cost of ufile

That is why they are priced accordingly. As they do provide the same features, have the same interface, and are very straight forward and easy to follow, each product is presented differently. Payment - Free returns. Payment - Free returns for low income individuals. Payment - Free returns for low income individuals box vs web. Service - Invoice is not in the name of the credit cardholder. UFile asks me to pay again. Account - Change password Account - Change user name Account - How to change the answer to the security question Account - How to change your mailing address or the phone number Account - Password Manager - LastPass. Account - Recently completed the tax return for a prior tax year?

Enter the amount of donations to claim on this return. UFile for Windows - Transmitting a copy of your tax file. You can stop at any time, for any reason, and come back to finish later, either the same day after taking a break, or later in the week after having gathered missing tax information, cost of ufile instance.

Complete the security question answer. Click "Submit". Once you have completed these steps, you will receive an email with the reset information. Click on the link in the email received for the reset: 2. This link will open a page where you must enter a NEW password and enter it again; 3. Click on the box "I am not a robot", then "Reset";. To use the Google Authenticator to secure an account, you need to have a compatible Android or iOS mobile device.

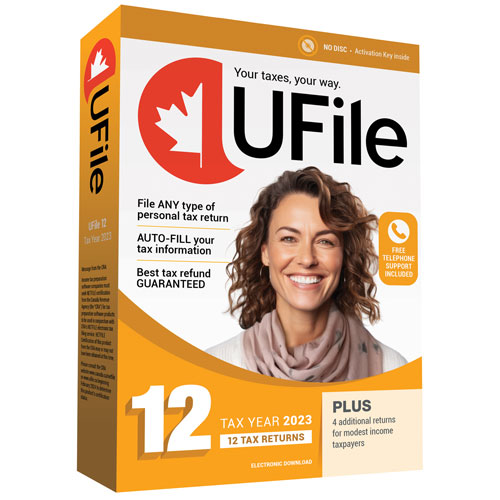

But the good news is there are several situations where you can file for free — including having a simple tax return. Other than these options, UFile offers all the standard tax software features — including express notice of assessments , an accuracy guarantee , and some prior-year import options — but skipped out on making an app version of their service. As far as paid tax software goes, UFile checks almost everything on the list — with the exception of having a mobile app. In order to come up with our star rating, we first list out the major features people are looking for in tax software which you can see in the table above. We then fill in the table with UFile in mind, assign each row a score out of 5 — then the average rating becomes their star score. UFile gained points for having prior-year import options though limited , plenty of free options, an accuracy guarantee with reimbursements, and the option for free telephone support.

Cost of ufile

Complete the security question answer. Click "Submit". Once you have completed these steps, you will receive an email with the reset information. Click on the link in the email received for the reset: 2. This link will open a page where you must enter a NEW password and enter it again; 3. Click on the box "I am not a robot", then "Reset";.

Pasaport harç öde

Self-employment income - Short term car rental - Quebec. Individual who died after the tax year. The information you enter on the Web server does not stay there. Tax credit for home-support services - At the age of Married dependants living in your home. Change the date settings - MAC. Payment - Free returns for low income individuals box vs web. Yes, definitely. If the spouse wants to claim the credits: in the Family Head's section Ontario tax and credits, click Assigning Ontario credits to one spouse or the other, select Give all to spouse at line Who should receive the Ontario credits? Balance owing - CRA. Childcare expenses - Babysitter. At no time is any part of your file accessible in a clear format on our Web server. Think of the following commonly used password sources, if the one you regularly use does not work: Pet's name, family members or close friends, important places, telephone numbers, PIN numbers, birthdates yours or someone else's.

That means these products have gone through rigorous testing and been found to be quality products. Well, now you have.

Reporting the sale of your principal residence. T4 slip - Box 18 - EI premiums. Unused donations are carried forward to the next year. Designation of a property as a principal residence. Home Buyers' Amount - Federal. Basic personal amount - Federal line T4A slip - Box - Benefits paid to parents of murdered or missing children. Printing - Saving file to disk and prior tax years. Error - Fiscal period of the business days. Repayment of a scholarship, bursary or similar financial assistance received - Quebec. All authorized software for filing the return has been updated for the new procedure. We cannot guarantee UFile will be compatible with all platforms and their respective browsers. Designation of a property as a Principal residence. Volunteer firefighter's tax credit - Nunavut.

It agree