Cleartax gst search

Elevate processes with AI automation and vendor delight.

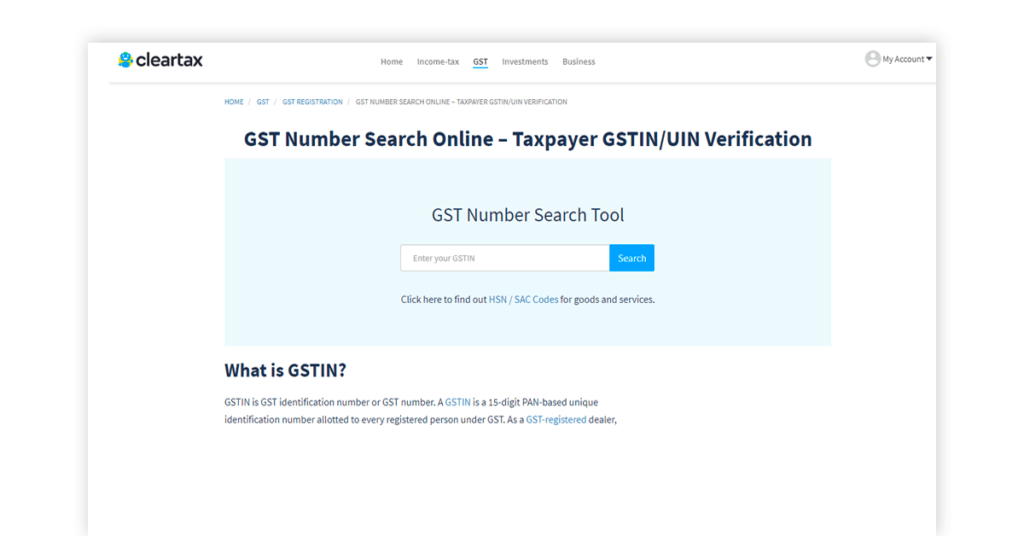

Find the HSN Code. GST number search. Income tax calculator. How to calculate Income taxes online? GST calculator. GST calculator is a handy ready-to-use online calculator to compute the GST payable for a month or quarter. SIP calculator.

Cleartax gst search

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity. For Personal Tax and business compliances. This system has been introduced for the systematic classification of goods all over the world. It has about 5, commodity groups, each identified by a six-digit code, arranged in a legal and logical structure. It is supported by well-defined rules to achieve uniform classification. The main purpose of HSN is to classify goods from all over the World in a systematic and logical manner. This brings in a uniform classification of goods and facilitates international trade. The HSN system is used by more than countries and economies for reasons such as:. Harmonized System of Nomenclature number for each commodity is accepted by most of the countries. The HSN number remains same for almost all goods. However, HSN number used in some of the countries varies little, based on the nature of goods classified. Later Customs and Central Excise added two more digits to make the codes more precise, resulting in an 8 digit classification.

Section XI. Get IT refund status.

Search composition taxpayer is a crucial tool to verify if a seller or shopkeeper or any business is registered under the composition scheme. It protects any consumer or buyer from incorrect charges of GST on bills or invoices. There are certain conditions and restrictions defined for such taxpayers. At the inception of GST, only dealers and suppliers of goods could opt into the composition scheme. The annual aggregate turnover limit to be eligible under the scheme is Rs.

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity. For Personal Tax and business compliances. This system has been introduced for the systematic classification of goods all over the world. It has about 5, commodity groups, each identified by a six-digit code, arranged in a legal and logical structure.

Cleartax gst search

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity. For Personal Tax and business compliances. Updated on: Friday, 16 February, Explore now.

Super funny images

ClearOne App. Trademark Registration. About us. Engineering blog. Where are HSN codes required to be mentioned? Tobacco and tobacco substitutes that are manufactured. Compound Interest Calculator. Should HSN codes be mentioned by taxpayers registered under the composition scheme or taxpayers supplying exempted goods? Articles of apparel and clothing accessories that are not knitted or crocheted. Income Tax e Filing. Solutions For Leadership. Elevate processes with AI automation and vendor delight. Tax filing for traders. Accounts Payable. How to identify the GST number?

Get GST Compliant!

How to complain about a fake GST number? Letters Of Credit. MSME Registration. Oil seeds and oleaginous fruits, grains, straw and fodder, seeds and fruit, and industrial or medicinal plants. Cement HSN Code. Clear serves 1. Section I. Stock Market Live. Solutions For Leadership. Residue and food waste, prepared animal fodder. Product Guides. Base Metal and Articles Made of Base Metal Chapter 72 Iron and steel Chapter 73 Articles made of iron or steel Chapter 74 Copper and articles thereof Chapter 75 Nickel and articles thereof Chapter 76 Aluminium and articles thereof Chapter 77 Reserved for possible future use Chapter 78 Lead and articles thereof Chapter 79 Zinc and articles thereof Chapter 80 Tin and articles thereof Chapter 81 Other base metals, cermets, and articles thereof Chapter 82 Tools, implements, spoons and forks, cutlery, of base metal, and parts thereof Chapter 83 Miscellaneous articles made of base metal Section XVI. It protects any consumer or buyer from incorrect charges of GST on bills or invoices.

I apologise, but it not absolutely approaches me. Who else, what can prompt?