Cheapest renter insurance

A landlord's homeowners insurance policy doesn't cover a renter's personal possessions, so if you're a renter, cheapest renter insurance need renters insurance to protect your belongings. Renters insurance generally covers three areas: personal property, personal liability and additional living expenses incurred if your rented home is uninhabitable. Personal property includes electronics, clothing, furniture and even kitchen and bath supplies, cheapest renter insurance. Liability coverage protects you financially from damages you cause to others, generally for bodily injury or property damage.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Cheapest renter insurance

We help customers realize their hopes and dreams by providing the best products and services to protect them from life's uncertainties and prepare them for the future. The place you rent is your home, and like a home, you want it protected. Allstate renters insurance, also known as tenant insurance, is reliable, affordable and can cost less than you think. Similar to home insurance, renters insurance is a policy that protects you, your belongings and your living arrangements. It also typically includes other coverages like family liability coverage, additional living expenses and guest medical protection. Factors like location, type of coverage and the value of your possessions determine your monthly renters policy premium or payment. Request a renters insurance quote today. With Allstate renters insurance, there are typically four types of coverage: personal property, liability, guest medical and additional living expenses. Personal property protection covers the loss of your belongings if they're stolen or damaged both inside and outside of your home. Family liability protection can help protect you from financial loss if you're legally obligated to pay for another person's injuries or damage to another person's property. What if you are over at a friend's house and accidentally sit on their brand-new drone, breaking the camera lens?

The sample policy quoted included the following coverage limits and deductible:.

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More. Mike Miller is a writer with a decade of experience producing product and service content to help consumers make informed purchasing decisions. In his spare time, Mike enjoys riding and fixing motorcycles, reading a good book and spending time with his wife and two cats. Sabrina Lopez is an editor with over six years of experience writing and editing digital content with a particular focus on home services, home products and personal finance.

This renters rate and coverage are provided and serviced by affiliated and third-party insurers.. Read more. Or, quote another product list with 39 items. Renters looking to protect their stuff can rely on affordable renters insurance from Progressive, but coverage goes beyond your personal belongings. A renters insurance policy may also pay for medical bills if someone is injured due to an occurrence, or additional living expenses if your home is unlivable due to a covered loss.

Cheapest renter insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. Imagine coming home to find all of your possessions destroyed in a fire. NerdWallet evaluated some of the top renters insurance companies for financial strength, ease of filing and tracking a claim, coverage options, discounts and other factors. Below are the companies that came out on top. Our writers and editors follow strict editorial guidelines that ensure fairness and accuracy so you can choose the financial products that work best for you.

Mujeres de nicaragua en facebook

Pros Available in all 50 states Company sells a number of other insurance coverages for bundling. Shop and compare At Ratehub. Washington, D. Review your coverage. Additional living expenses coverage also called ALE can help pay for a short-term rental and additional expenses like restaurant meals, for example. Your cost may vary depending on your location, coverage and personal property needs. The higher your credit score, the less likely insurers expect you to make a claim. Find the right savings account for you. The best car insurance companies for young adults. Updated: Mar 4, Also keep in mind that it's often a better idea to buy separate policies when living with roommates. Average annual rate. What are the benefits of renters insurance? One common upgrade you may want to add to your renters policy is replacement cost coverage for your personal belongings. Our sample rates are for informational purposes only.

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission.

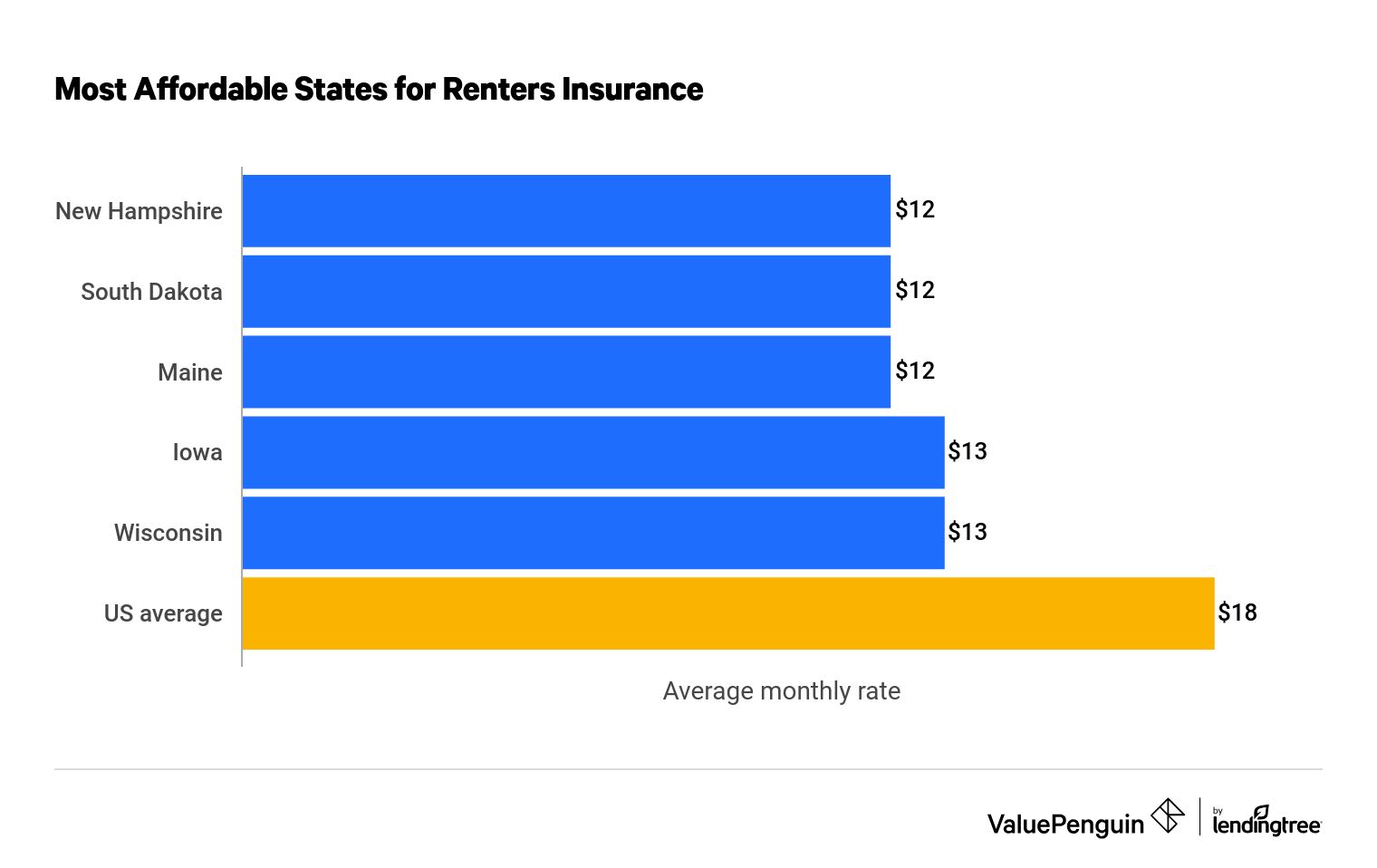

You may be able to list multiple roommates on a policy, but make sure you're aware of the risks of doing so. North Dakota. Optional types of renters insurance coverage. Discover our top rated renters insurance providers in your state using the dropdown below:. These are sample rates generated through Quadrant Information Services. The Average Renters Insurance Cost for Electronics, clothes, bikes and more. For those with high-value items, it's possible to add on extra coverage for things like cameras, jewelry and cameras, for example. While renters insurance may help cover some types of water damage , it's important to note that flood damage is not covered. If your laptop was stolen from the coffee shop when you went to get a refill, your renters insurance can help you replace it. Unlike getting a standard home insurance quote , a provider does not generally require a soft credit check for tenant insurance, but if the option is available, it will help to reduce the price you pay. Can renters get flood insurance? For example, Alaska has the least expensive renters insurance rates, while Mississippi has the most expensive rates. Lemonade is great for renters who are looking for cheap insurance and want to spend as little time interacting with their provider as possible.

I confirm. And I have faced it. Let's discuss this question.

I congratulate, what necessary words..., an excellent idea