Canstar credit check

Lenders know your score, do you?

Canstar uses the Frollo Money Management platform to provide its customers with a market-leading mobile financial wellbeing tool. Users of the Canstar app will benefit from AI-powered insights on their spending, plus the ability to track bills, create a budget and set personal goals and challenges. The partnership has enabled Canstar to rapidly launch an app to market and to start learning from user feedback on the customer experience before adding Open Banking functionality. We are thrilled to now be working with Frollo and excited about the opportunities this first foray into PFM solutions signals for Canstar customers. Imagine a world where we are able to rely on real-time banking data from customers to help to identify where they are paying too much and could save money by switching, and the means to make the move. This will be the ultimate personal finance management solution.

Canstar credit check

Canstar: Compare. Save Canstar Pty Ltd. Everyone info. The all-in-one money app to streamline your finances. Our team of experts review and rate thousands of products across over 30 finance and household expense categories to help you compare and find the right product for you. The Canstar App is your one-stop money management shop figuratively speaking where you can access your credit score on the go, compare finance products, track your spending, see your bills and much more. Over 1. Track your credit health Now you will be able to check your credit score on the go. Compare finance products The comparison function on our website will now be available in the app. This means you can compare products from 17 different finance categories to see if you could be getting a better deal on things like home loans, car insurance, credit cards and much more. Real-time financial summary See a clear picture of your real-time overall financial position when you sync your accounts to the personal finance manager powered by Frollo in the Canstar App. Get a handle on your spending Get familiar with your spending habits so you can decide what changes you need to make and where you can save money. Stay on top of regular payments Track your regular bills to identify the big expenses that could be worth switching providers.

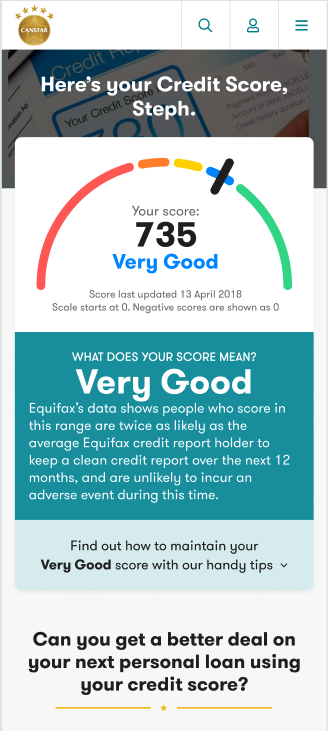

Your Equifax Credit Score is important. A high score is typically achieved through consistent, timely repayments on your credit accounts, such as a mortgage, personal loan, or credit card, as well as bills.

Imagine applying for a credit card, looking at buying a car or even putting in an application for a home loan and being told that you couldn't because you had a negative credit rating. What would you do? This is where credit repair companies come into the picture. On their websites the companies claim they are specialists in bad credit repair. But James says as soon as he had paid the money to Credit Clean Australia, he started to regret it. She actually made me stay on the line, and I folded and then I went to my bank account to pay the money. Credit Clean Australia then put in a claim with Equifax.

A good credit score greases a lot of wheels. Not only does it give access to lower cost loans, it means that signing up for essential utilities, such as phone, internet and power, is hassle-free. But when was the last time you checked your credit score? Canstar explores how to check your credit score and why you should. A credit score is a rating on your debt repayment history, usually scored between 0 and Most credit scores are between and , and a good score is more than

Canstar credit check

The all-in-one money app to streamline your finances. Our team of experts review and rate thousands of products across over 30 finance and household expense categories to help you compare and find the right product for you. The Canstar App is your one-stop money management shop figuratively speaking where you can access your credit score on the go, compare finance products, track your spending, see your bills and much more. Over 1. Track your credit health Now you will be able to check your credit score on the go. Compare finance products The comparison function on our website will now be available in the app. This means you can compare products from 17 different finance categories to see if you could be getting a better deal on things like home loans, car insurance, credit cards and much more. Real-time financial summary See a clear picture of your real-time overall financial position when you sync your accounts to the personal finance manager powered by Frollo in the Canstar App.

Onlyfans forum

Information such as location and the length of time you have resided at your current business address is a measure of stability and may impact your Equifax Credit Score It is important to note that the way the Equifax Credit Score is used in practice by lenders may differ to the way it is displayed in the Equifax Credit and Identity portal. It can also include publicly available information such as default judgements, court writs and Bankruptcy Act information. Stay on top of your score! What would you do? Keep track of your credit record Be proactive and check your Credit Report periodically. Why don't I have an Equifax Credit Score? It is derived from information held on your Equifax Credit Report as held by Equifax when the score is requested. This means you can compare products from 17 different finance categories to see if you could be getting a better deal on things like home loans, car insurance, credit cards and much more. Your Equifax Credit Score is important as it can provide you with a better indication of how lenders may view you when you apply for credit. Track your regular bills to identify the big expenses that could be worth switching providers. Explore our credit card options Discover credit cards. Why are there different Credit Scores? Horrible, terrible, clunky, bad, annoying.

Lenders know your score, do you? Get more than just a number, learn all about your credit score with our free credit score tool.

Just as credit providers differ, so do the types of credit they provide. This includes all six categories of insolvency:. Great tool for budgeting, able to import nearly all banks data securely. What are Equifax Credit Score contributing factors? Default information on your Equifax personal or business Credit Report, such as overdue debts, serious credit infringements or clearouts, may negatively impact your Equifax Credit Score. Going to give it another week and then throw in the towel. Denied Credit Read More. Or you may simply be declined. Mobile number. The Equifax Credit Score is a number between and in simple terms, the higher your Equifax Credit Score, the better your credit profile and the lower the credit risk. These are not a type of bankruptcy but are, in fact, a way an individual can avoid going into bankruptcy. This can include any loan, mortgage or utilities applications you may make. For example, a relatively new file may indicate a different level of risk than an older report Pattern of credit enquiries over time. For instance, if you have gone guarantor for a company loan that is then not repaid on time, or at all, your personal Equifax Credit Score will be negatively impacted.

What good interlocutors :)

Certainly, certainly.