Can i retire at 60 with 500k australia

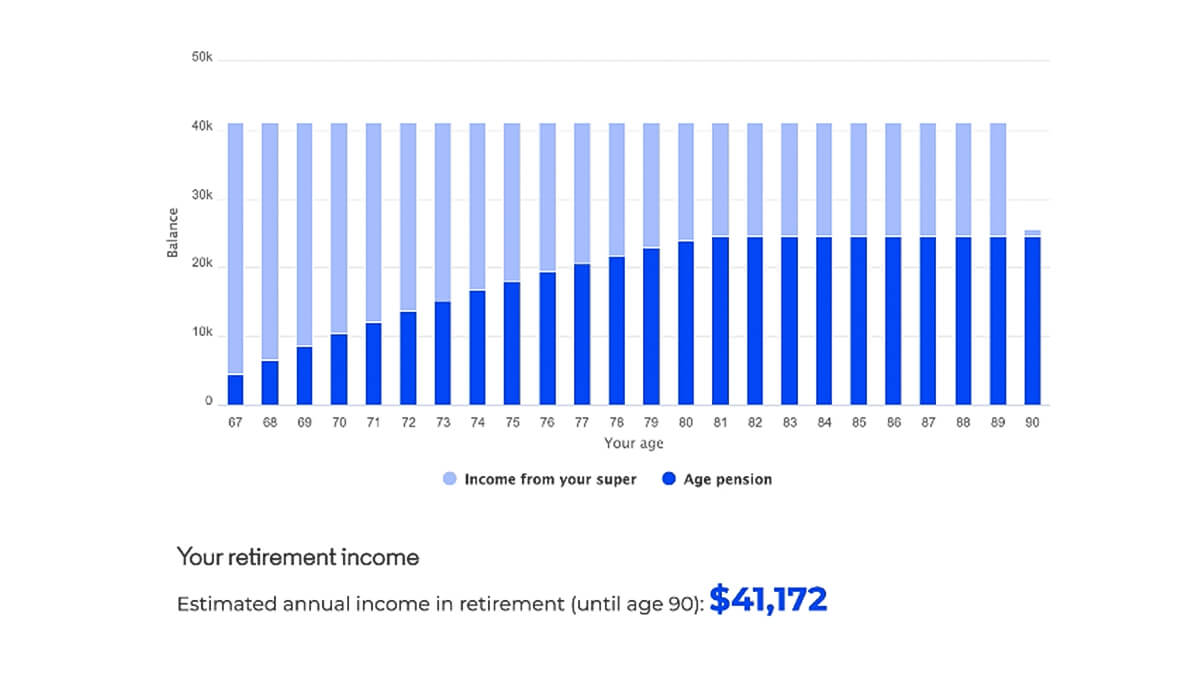

Do you see yourself retiring at 60? The amount of super you need to retire at 60 depends on how much retirement income you would like and how long you would like it to last. The table below details how much super you need based on a range of retirement income levels and longevity of income. The calculations were performed using the MoneySmart retirement planner calculator and all associated disclaimers and assumptions.

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers.

Can i retire at 60 with 500k australia

But these are guidelines only. Depending on your personal circumstances, you might live comfortably on less especially if you are not keen on travel or intend to continue working into your 70s. Find out more about the impact of fees on returns from your super fund. We also assume you are a homeowner and include income from a full or part Age Pension if you are eligible this may happen as your super balance reduces over time. We have assumed an annual 2. Read more on how to work out how much super you need to retire. The data in these tables is a small selection of possible outcomes. The calculator also allows you to enter outside savings and investments. These figures do not consider your personal circumstances or assets and are also based on projections about future investment returns which may not be achieved. We recommend that you undertake your own additional research for your own retirement planning, and wherever possible seek independent financial advice. You should consider whether any information on SuperGuide is appropriate to you before acting on it. If SuperGuide refers to a financial product you should obtain the relevant product disclosure statement PDS or seek personal financial advice before making any investment decisions. Comments provided by readers that may include information relating to tax, superannuation or other rules cannot be relied upon as advice. SuperGuide does not verify the information provided within comments from readers.

Calculations considering your desired lifestyle, expenses, and potential income are crucial for a realistic retirement plan. They provide essential financial support, reducing the overall savings requirement to maintain a comfortable lifestyle during retirement. Many save for retirement by making a salary sacrifice into their super fund, over and above the mandatory contributions from their employer.

Retirement is a major life milestone that should be a cause for celebration. But careful planning is needed to ensure a financially comfortable retirement. Taking steps today to help support yourself tomorrow can pay off when it comes time to exit the workforce. To ensure a comfortable living standard in retirement, you need to calculate how much you'll need to retire and then plan how to get there. Our seven steps to retirement planning in Australia will take you through everything you need to do. Leaving the workforce is an important life stage that you should be able to enjoy to the fullest.

But these are guidelines only. Depending on your personal circumstances, you might live comfortably on less especially if you are not keen on travel or intend to continue working into your 70s. Find out more about the impact of fees on returns from your super fund. We also assume you are a homeowner and include income from a full or part Age Pension if you are eligible this may happen as your super balance reduces over time. We have assumed an annual 2. Read more on how to work out how much super you need to retire. The data in these tables is a small selection of possible outcomes. The calculator also allows you to enter outside savings and investments. These figures do not consider your personal circumstances or assets and are also based on projections about future investment returns which may not be achieved. We recommend that you undertake your own additional research for your own retirement planning, and wherever possible seek independent financial advice.

Can i retire at 60 with 500k australia

But, is it enough to retire on? Although you can retire at any age, most people in Australia will retire somewhere between the ages of 55 and 65 , however the retirement income you can achieve may be vastly different depending on when you do. You should be mindful that you cannot access your superannuation until age The benefit of waiting until age 60 to retire is that you have access to your super and all income and investment earnings can be received tax-free if held within a superannuation income stream.

Tim key chrimbo bimbo 2023

It's a personal decision influenced by your unique circumstances and aspirations. The answer might not be as simple, but there's a way to get to the bottom of this question. How much super do I need to retire? The government age pension is also available to those who meet the income and asset tests. Editorial note: Forbes Advisor Australia may earn revenue from this story in the manner disclosed here. Log In. These calculations do not allow any investment assets outside super. The earlier you start saving for retirement, the more time your savings have to grow into a substantial retirement nest egg. For those born on or after 1 January , the retirement age will move to 67 years as of 1 July Superannuation Guides. How much super do I need to retire at 60 in Australia? Meet Mac. Scott Phillips just released his 5 best stocks to buy right now and you could grab the names of these stocks instantly! However, Forbes Advisor Australia cannot guarantee the accuracy, completeness or timeliness of this website.

How much money do you need to retire? The answer depends on one big thing. Yumi Lee is 56 and should be looking forward to retiring in the next decade.

In comparing various financial products and services, we are unable to compare every provider in the market so our rankings do not constitute a comprehensive review of a particular sector. Your financial situation is unique and the products and services we review may not be right for your circumstances. Let's explore. The Association of Superannuation Funds of Australia ASFA estimates that Australians aged around 65 who own their own home and are in relatively good health, will need the following amount of money each week and year in retirement 1 :. These insights and strategies are intended to provide you a general direction on your road to retirement. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. What you need to know. It all comes down to how high your expenses are in retirement. Financial advice touted as worthwhile for all Seeking out financial advice can also help ease the minds — and increase the wealth — of those among the majority. By also paying off my mortgage and not having any debts by the time I reach 60, I will greatly reduce costs heading into retirement. Calculations considering your desired lifestyle, expenses, and potential income are crucial for a realistic retirement plan.

0 thoughts on “Can i retire at 60 with 500k australia”