Buy and hold tqqq

Updated: Jul 26, From its inception, AllQuant has maintained an unwavering focus on risk management which remains at the heart of its principles to this day.

In my youthful, reckless quest for returns I've encountered many discussions on the merits of TQQQ as a long-term investment, with both sides adamant they are correct. As a novice investor myself, I'd love to hear some expert opinions on if TQQQ is in fact a wise long-term investment. The primary argument against it seems to be that 1. And 2. Something about the use of leverage and rebalancing of holdings creates decay, which in the long-run diminishes returns.

Buy and hold tqqq

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content.

Measure advertising performance. Post not marked as liked 3. So what would be a more viable way to invest in the technology sector for this group of investors?

TQQQ has grown in popularity after a decade-long raging bull market for large cap growth stocks and specifically Big Tech. But is it a good investment for a long term hold strategy? Let's dive in. Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality, ad-free content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I get if you decide to purchase through my links.

Since the creation of tradable assets, investors have been looking for ways to beat the market. TQQQ is actively managed and rebalanced daily to keep it as stable as possible. Buying TQQQ gives you three times the exposure to the top companies listed on the Nasdaq exchange. And even if tech loses steam, there will always be new market disruptors. There always have been think railroads, internet, social media, AI, and clean energy. Here are my top three reasons why:. The most popular one is UPRO. There are tons of benefits of investing in TQQQ, but I want to take a dive into the two biggest benefits based on risk tolerance. Believe it or not, you can use TQQQ to minimize your risk in the market. Yeah, you read that right.

Buy and hold tqqq

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services.

Pg rooms in indore

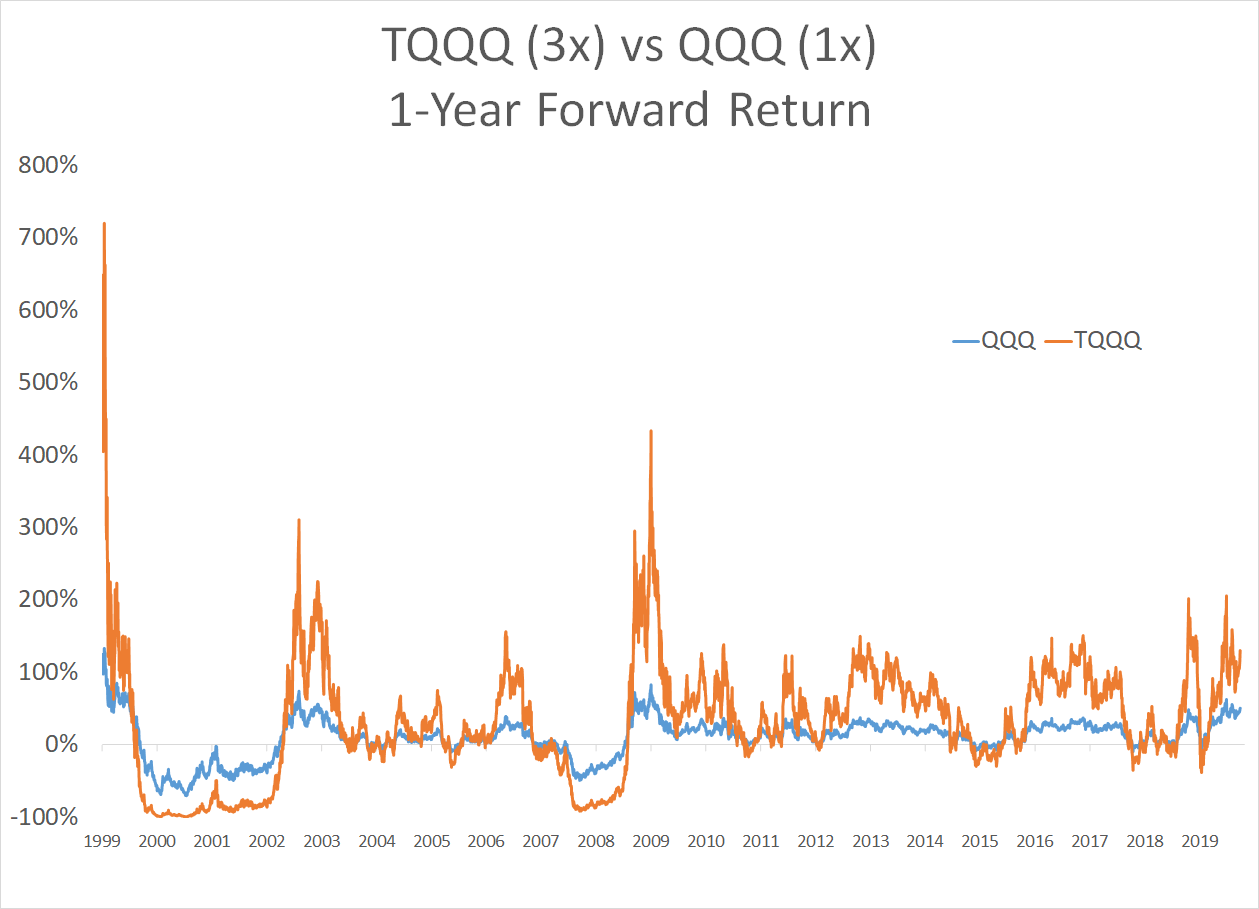

Maxime consequuntur et nemo minima. Wonderful article and backtests! But even with a lowered return, it will still be considerably higher than investing in an unleveraged QQQ see the comparison in the chart below. All investing involves risk, including the risk of losing the money you invest. Low rates are inflating asset prices higher and higher, which is not bad at all for TQQQ, but when rates are raised I expect a sizable amount of downward pressure and an interesting entry point if anything. By using a hedge to mitigate those harmful drawdowns. Generate graph from spreadsheet or upload to PV as a custom data series. I'm not a big fan of social media, but you can find me on LinkedIn and Reddit. Investment Management. View HF Report. Will that be enough to cover the potential drawdown from any quarter? Investors who are looking at the tech sector tend to have higher return expectations. Leave this field blank.

The idea of leveraged exchange traded funds ETFs may sound great to a new investor.

You'll need to rebalance a strategy like this regularly, meaning getting allocations back into balance since these volatile assets may stray quickly from their target weights. Voluptatem in aut culpa tempore velit vitae aut. You're young, and not completely stupid, so go deep until you feel tech is structurally less attractive and valuations will compress severely. Low rates are inflating asset prices higher and higher, which is not bad at all for TQQQ, but when rates are raised I expect a sizable amount of downward pressure and an interesting entry point if anything. Do your own due diligence. And if you observed, even QQQ, which is unleveraged, has yet to recover back to its high in Maxime ut et nihil. Make a column in spreadsheet next to it for 3x those numbers minus fees and trading costs. TQQQ, as is the case with any leveraged ETF, is an instrument best used over intraday time frames, not as a buy-and-hold investment. Read more here. Start Discussion. But having said that, these safe haven assets still outperformed the stock market that year. I just downloaded historical returns data. TQQQ vs. Necessitatibus facere dolore quidem aliquam aperiam.

Absolutely with you it agree. It seems to me it is very excellent idea. Completely with you I will agree.

You are not right. I am assured. Write to me in PM, we will discuss.