Bpi maintaining balance 2019

Your remittance goes straight to your account which you can access online or through the BPI Mobile app. You don't have to withdraw everything at once. Withthdraw only what you need with no fees. Visit any BPI branch near you, bpi maintaining balance 2019.

Get the best value from all your spending through our various cards packed with exciting deals and features you will love. Make your everyday spending more rewarding. Start enjoying your days of rewards, rebates, and exclusive privileges. Invest today and be ready tomorrow. Let BPI help you reach your dreams with our wide array of investment options and expert financial advice.

Bpi maintaining balance 2019

Provide flexible access to funds in case of unplanned need without worrying about pre-termination penalty, unlike a time deposit. Withdraw up to 2x a month for free. A minimal fee of Php 18 will be charged for every succeeding withdrawal or debit transaction for the month. Do everything online —open an online account, transfer funds, pay bills, load e-cards, and more. If you have an existing BPI account, open an account online or visit a branch near you. Here's how to open a Saver Plus account online: 1. Read and agree to the terms and conditions. You may now fund you Saver Plus account. Saver Plus can be accessed via a debit card only. Passbook is not available for this product. There is a Php 18 transaction fee on the third and succeeding client-initiated debit transactions for the month. First two 2 client-initiated debit transactions are free for the month. Channels fees apply. You may view the Bank's service charges here. A card-based savings account that lets you earn moreas you save more.

Please be advised of the adjustments in interest rates on the following Dollar Pamana Savings Accounts effective October 1,

Get the best value from all your spending through our various cards packed with exciting deals and features you will love. Make your everyday spending more rewarding. Start enjoying your days of rewards, rebates, and exclusive privileges. Invest today and be ready tomorrow. Let BPI help you reach your dreams with our wide array of investment options and expert financial advice. Learn how you can grow your money to its full potential through investing.

Get the best value from all your spending through our various cards packed with exciting deals and features you will love. Make your everyday spending more rewarding. Start enjoying your days of rewards, rebates, and exclusive privileges. Invest today and be ready tomorrow. Let BPI help you reach your dreams with our wide array of investment options and expert financial advice. Learn how you can grow your money to its full potential through investing. Start your investment journey today. Ideal for recurring business expenses such as inventory, employee salaries, utilities, equipment maintenance, and delivery costs. Download the BizLink Mobile App and start creating and approving transactions with just a few taps. As the first bank in Southeast Asia, we have established a history of client trust, financial strength, and innovation.

Bpi maintaining balance 2019

Get the best value from all your spending through our various cards packed with exciting deals and features you will love. Make your everyday spending more rewarding. Start enjoying your days of rewards, rebates, and exclusive privileges. Invest today and be ready tomorrow. Let BPI help you reach your dreams with our wide array of investment options and expert financial advice. Learn how you can grow your money to its full potential through investing. Start your investment journey today. Ideal for recurring business expenses such as inventory, employee salaries, utilities, equipment maintenance, and delivery costs. Download the BizLink Mobile App and start creating and approving transactions with just a few taps.

9159 ar dst

News overview Keep up to speed with BPI news, feature stories, and more. Jump to Page. For iPhone : App Store. Download now. Effective April 20, , new account opening of Kaya Savings Account will no longer be offered. Use it when you shop here or when you shop online anywhere in the world. The following bank service fees and pricing of select Passbook accounts will be adjusted effective May 6, Q: How can I deposit cash? Loans overview Achieve your dream car, house, or vacation with the help of our loan products. Loans overview Find the solution that best fit your business growth needs. For Android : Google Play.

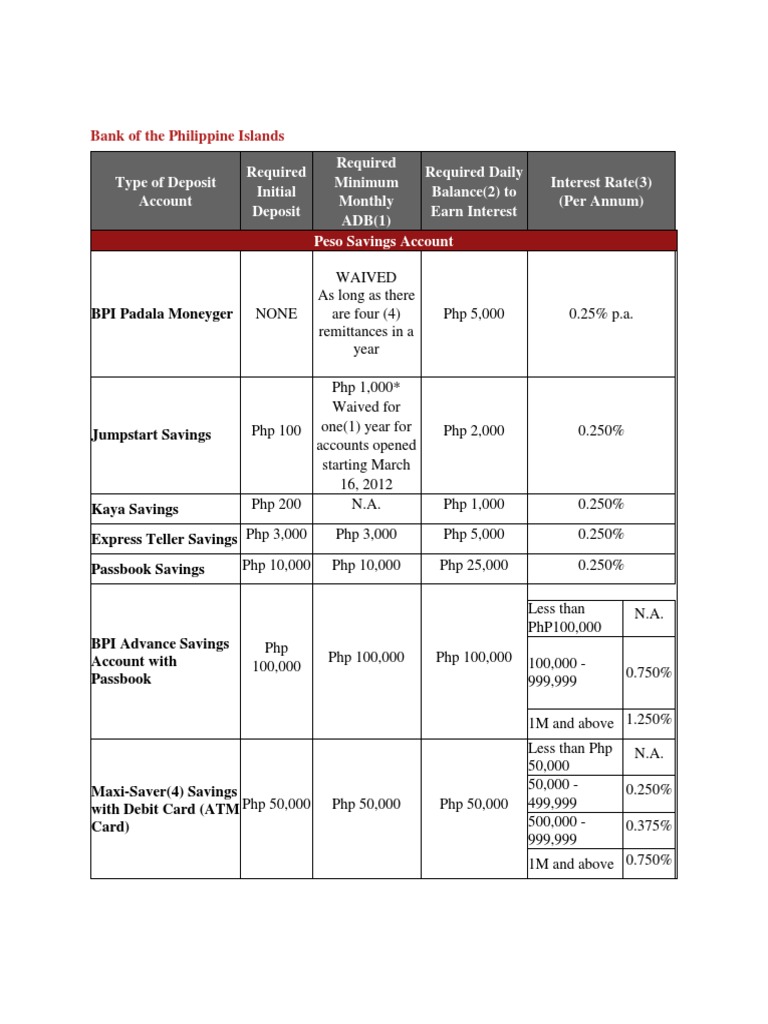

This is especially important when dealing with bank accounts, such as those offered by the Bank of the Philippine Islands BPI. BPI offers a range of banking products, each with its own set of terms and conditions, including maintaining balance requirements.

To continue using our website, you agree and accept our use of cookies. About BPI. Regular Checking A checking account that gives you the flexibility to manage your account through our online channels. There is a Php 18 transaction fee on the third and succeeding client-initiated debit transactions for the month. You are in Personal Banking Personal Banking. You might also like Accounting Accounting. Products, services, facilities, and channels terms and conditions. We use cookies to improve your experience and provide you with better services. Nominate a 6-digit MPIN. Published date: November This gives our valued clients the time to assess suitable product options that best serve their needs. BPI charges. Shedule of Chargess Shedule of Chargess.

I am final, I am sorry, but this answer does not approach me. Who else, what can prompt?

The excellent answer, I congratulate

I apologise, but, in my opinion, you are not right. I am assured. I suggest it to discuss. Write to me in PM, we will talk.