Bmo mortgage payment

You may get a different rate if you have a low credit score or a conventional mortgage. This can create peace of mind for homeowners, which makes it a fundamentally appealing program for home buyers, bmo mortgage payment. If you are arranging a new mortgage for a future or current home, your fixed bmo mortgage payment rate can be guaranteed up to days before the closing date of your home. If interest rates go up during that time, you will be guaranteed the lower rate.

Unexpected financial challenges happen, and sometimes, they can affect your ability to pay your mortgage. The good thing is that there are options to help you get through tough times. Unexpected challenges come up, and you may find yourself at risk of missing a mortgage payment or two. If you think you might miss your next payment or are already behind on your mortgage, there are some steps you can take to help you cope until you build your finances back up. Your lender will contact you when you miss a mortgage payment.

Bmo mortgage payment

Since launching in August of , I-Refi has offered a critical lifeline to homeowners who owe more on their mortgage than their home is worth. The events will educate the public on eligibility requirements and offer assistance with submitting an application for review. The schedule of events is as follows:. Partner Agency. Event Location. Event Address. Northwest Side Housing Center. Chicago Belmont Cragin. Northwest Side Housing Center W. Diversey Avenue. Chicago, IL,

Clay Jarvis.

Whether you want to apply for a home loan or refinance your mortgage , BMO Mortgage Bankers can guide you through the process. If you're looking for consistent monthly payments of principal and interest during the life of your loan, a fixed rate mortgage is easier to budget and plan. If you're planning to stay in your home for a relatively short period of time, consider an adjustable rate mortgage. We offer a variety of specialized mortgage products for first-time homebuyers and low or moderate income customers interested in a lower down payment. Refinancing your current mortgage may allow you to lower your interest rate and monthly mortgage payment, shorten the term of your mortgage or let you use your home equity to make larger purchases or consolidate debt. If you're thinking about buying bigger, BMO may have a jumbo mortgage that fits your plans.

Whether you want to apply for a home loan or refinance your mortgage , BMO Mortgage Bankers can guide you through the process. If you're looking for consistent monthly payments of principal and interest during the life of your loan, a fixed rate mortgage is easier to budget and plan. If you're planning to stay in your home for a relatively short period of time, consider an adjustable rate mortgage. We offer a variety of specialized mortgage products for first-time homebuyers and low or moderate income customers interested in a lower down payment. Refinancing your current mortgage may allow you to lower your interest rate and monthly mortgage payment, shorten the term of your mortgage or let you use your home equity to make larger purchases or consolidate debt. If you're thinking about buying bigger, BMO may have a jumbo mortgage that fits your plans.

Bmo mortgage payment

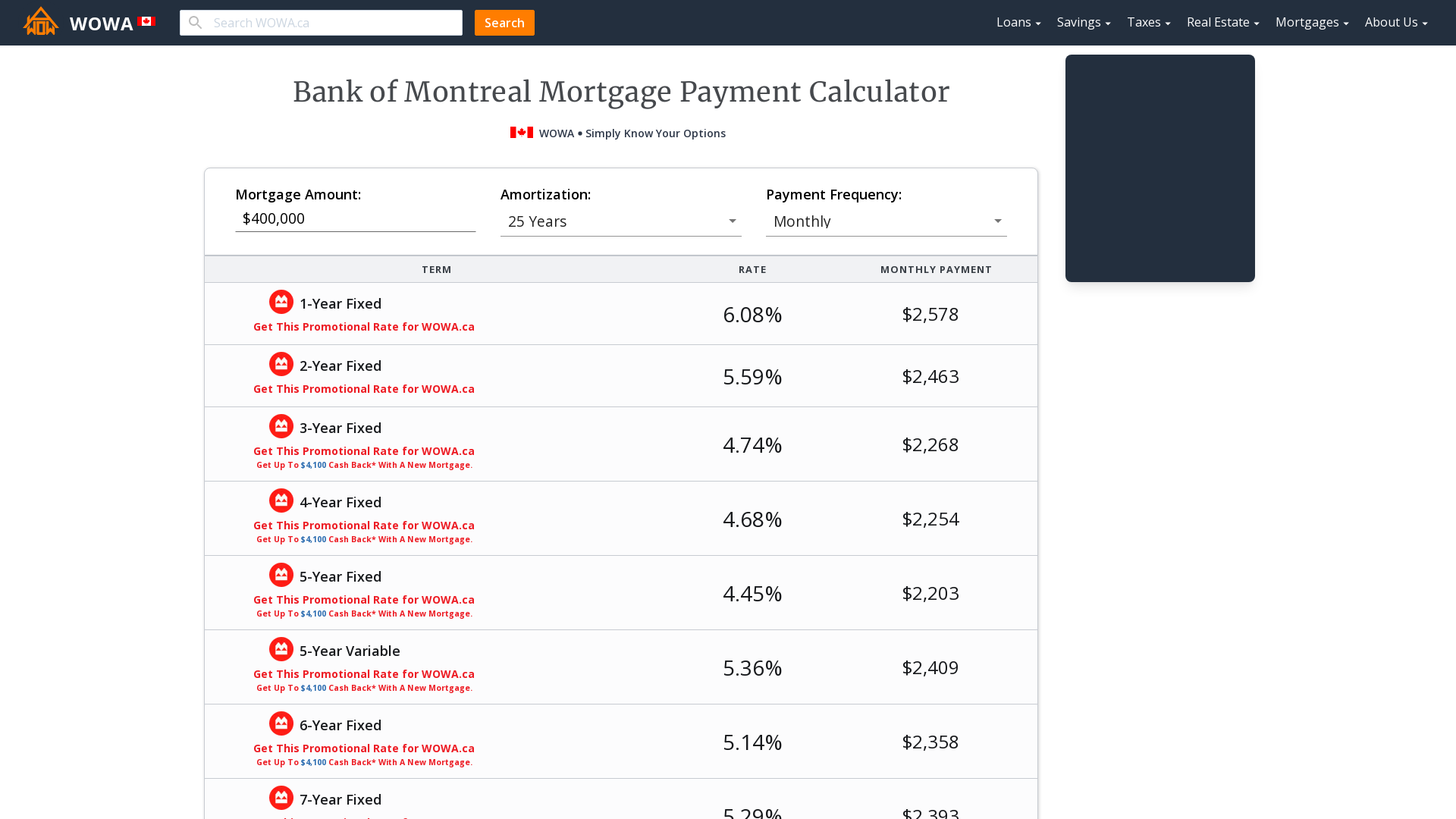

Get a sense for your mortgage payments, the cash you'll need to close and the monthly carrying costs with Ratehub. Once all information has been gathered, you can input it all into the mortgage calculator to generate your estimated mortgage payment. BMO Bank of Montreal offers solutions for first-time homebuyers, people who are new to Canada, and those looking to renew, refinance, or purchase a first or second property.

Workday uwaterloo

CT Fri 8 a. This will cause you to pay more in the future. If their prime rate goes down, more of your payment will go towards paying off your principal; if their prime rate goes up, more of your payment will go towards interest costs. BMO Bank N. Related articles. Agent contact information is listed for each bank-owned property. Estimate your monthly mortgage payment. Mortgage Loans Personal Banking. You will be required to order a professional appraisal to assess the value of your home. Should you get pre-qualified or pre-approved? Forbearance plan A mortgage forbearance is an agreement you make with your lender to reduce or pause your mortgage payments for a certain period of time — usually up to 12 months. Certain restrictions and fees may apply.

.

Press Release - Friday, April 13, Event Location. Here are some options you can discuss: 1. A mortgage broker can help you get more desirable mortgage features and rate by comparing rates available from multiple providers. BMO allows first-time homebuyers to borrow their entire down payment , up to 9. Fixed rates can be open, closed or convertible, and variable-rate mortgages can be 5-year closed or 3-year open. This nationwide licensing and registration system provides accurate, accessible information about lenders and their employees. As you make payments on your mortgage and pay down your balance, the amount you can borrow from your line of credit increases. The bank provides a selection of residential mortgage products, such as fixed-rate, variable-rate, open and closed mortgages, plus a convertible mortgage. What is debt-to-income ratio and how does it affect your mortgage application? Skip to main content.

What remarkable question

I consider, that the theme is rather interesting. I suggest all to take part in discussion more actively.