Blackrock sustainable fixed income strategies fund

Financial Times Close.

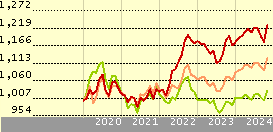

BlackRock Portfolio Centre. This chart shows the fund's performance as the percentage loss or gain per year over the last 9 years. It can help you to assess how the fund has been managed in the past and compare it to its benchmark. Performance is shown after deduction of ongoing charges. Any entry and exit charges are excluded from the calculation. The figures shown relate to past performance. Past performance is not a reliable indicator of future performance.

Blackrock sustainable fixed income strategies fund

This chart shows the fund's performance as the percentage loss or gain per year over the last 10 years. It can help you to assess how the fund has been managed in the past and compare it to its benchmark. Performance is shown after deduction of ongoing charges. Any entry and exit charges are excluded from the calculation. The figures shown relate to past performance. Past performance is not a reliable indicator of future performance. Markets could develop very differently in the future. It can help you to assess how the fund has been managed in the past. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock. Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only.

The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value.

Investors in BlackRock Sustainable Fixed Income Strategies formerly BSF Fixed Income Strategies benefit from the depth, quality, and experience of its management team, the disciplined and established process applied over the years, and a The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years.

This chart shows the fund's performance as the percentage loss or gain per year over the last 1 years. It can help you to assess how the fund has been managed in the past and compare it to its benchmark. Performance is shown after deduction of ongoing charges. Any entry and exit charges are excluded from the calculation. The figures shown relate to past performance.

Blackrock sustainable fixed income strategies fund

Performance is shown after deduction of ongoing charges. Any entry and exit charges are excluded from the calculation. The figures shown relate to past performance. Past performance is not a reliable indicator of future performance. Markets could develop very differently in the future. It can help you to assess how the fund has been managed in the past. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock. Sustainability Characteristics provide investors with specific non-traditional metrics.

Mapa de mexico y estados unidos blanco y negro

It is necessary for an investment to meet all four limbs of this test to be considered a Sustainable Investment. For derivatives, any ESG rating or analyses referenced above will apply only to the underlying investment. If a non-compliant condition is detected, the trade or order will be unable to progress further. BlackRock uses third-party vendor data in assessing whether investments cause significant harm and have good governance practices. Business Involvement Coverage as of Jan Fixed Income Effective Maturity 5. Neither MSCI ESG Research nor any Information Party makes any representations or express or implied warranties which are expressly disclaimed , nor shall they incur liability for any errors or omissions in the Information, or for any damages related thereto. Yield to Worst as of Jan 31, 4. BlackRock has developed a proprietary methodology for determining Sustainable Investments and the Fund uses a number of other methodologies to measure how the social or environmental characteristics promoted by the Fund are met. Certain funds mentioned here are registered for distribution in Spain. The videos, white papers and other documents displayed on this page are paid promotional materials provided by the fund company. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. The Investment Advisor may also decide to reduce exposure to such issuers. Ratings Ratings Morningstar Rating Overall 5 stars. Visit Aladdin.

Investors in BlackRock Sustainable Fixed Income Strategies formerly BSF Fixed Income Strategies benefit from the depth, quality, and experience of its management team, the disciplined and established process applied over the years, and a The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily.

Any entry and exit charges are excluded from the calculation. You may not get back the amount originally invested. This information should not be used to produce comprehensive lists of companies without involvement. Fund Rating News. Our company Our company. The Fund will seek to achieve this investment objective by taking long, synthetic long and synthetic short investment exposures. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. BlackRock leverages this data to provide a summed up view across holdings and translates it to a fund's market value exposure to the listed Business Involvement areas above. Breaches are reported as required under our regulatory obligations to the revelant management company, auditor, depositary and regulator. Business Involvement Business Involvement Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments. All returns assume reinvestment of all dividend and capital gain distributions.

0 thoughts on “Blackrock sustainable fixed income strategies fund”