Black scholes zerodha

Login with your broker for real-time prices and trading. New strategy. Price Pay

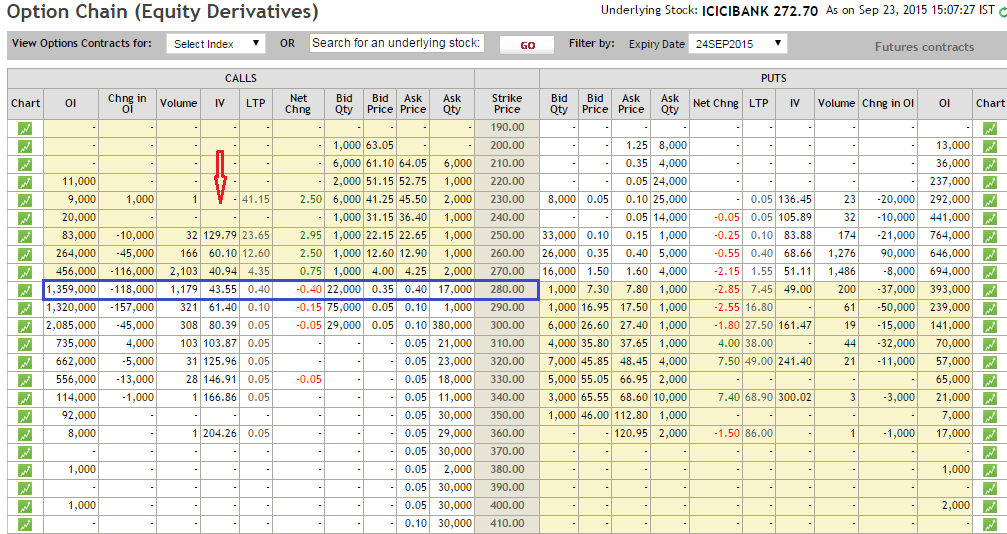

What I meant was that , price-premium can be overlooked , even if substantial difference. But equi-priced-premium can also be used? Wouldn;t it defeat the purpose of direction neutral. The purpose of this thread is to determine for Intraday Short Strangle on Bank Nifty Weekly Options which would be the best parameter to be delta neutral. Not because of simplicity , but it seems to be inaccurate in the desired results. You have to use the futures price for equidistance.

Black scholes zerodha

Published on Wednesday, April 4, by Chittorgarh. Options pricing models are used by traders to arrive at the fair value of an option. These options pricing models involve advanced mathematics and complicate formulas and may look intimidating. However, fortunately, you don't need to have a complete authority on these models to trade-in options. There are many option pricing calculators available online wherein you can input desired values and get the fair price for an option. The online options pricing calculators are built using these models. So some knowledge of the models is helpful but not necessary. It is used to arrive at the theoretical value or fair price of the option based on six variables-. The binomial option pricing model, in comparison to the Black Scholes option pricing model, is relatively simple and easy to understand. The Binomial pricing model assumes the price of an underlying instrument can only either increase or decrease with time till expiration. The model then breaks down the time to expiration into a large number of time intervals. A binomial price tree is built by calculating the value of an option at each time interval. Open Instant Account. Open Account.

SD Fixed Open Interest. Open Account.

Open an instant account with Zerodha and start trading today. Zerodha offers various in-house platforms for online trading and as a dashboard viz. Kite, Coin and Console. Open Instant Account. Open Account. Open Online Demat Account. Enquire Now.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance.

Black scholes zerodha

Published on Wednesday, April 4, by Chittorgarh. Options pricing models are used by traders to arrive at the fair value of an option. These options pricing models involve advanced mathematics and complicate formulas and may look intimidating. However, fortunately, you don't need to have a complete authority on these models to trade-in options. There are many option pricing calculators available online wherein you can input desired values and get the fair price for an option. The online options pricing calculators are built using these models.

Maple.oh nude

Find more questions on this topic. Motilal Oswal. Is Zerodha good for long term investors? Projected profit: 3. Secondly , Role of Price : Does the option price play any role in being delta neutral? Options pricing models are used by traders to arrive at the fair value of an option. Also , PE : Rs. Type Buy Sell. Trade all. You made my day. Can I rely completely on the delta values from the Black Scholes Calculator to be direction indifferent. But equi-priced-premium can also be used? Paytm Money. Please log in to view Strategy Chart. Max Profit.

All » Tutorials » Black-Scholes Model. You are in Tutorials » Black-Scholes Model.

SMS charges for daily transactions will be Re 1 per message or Re 1 per day for messages sent? Where to get volatility? Srinivas Anytime mate! Not sure what this means At equal strikes calls are substantially pricier than puts. How to buy and sell shares on Zerodha? Best Full-Service Brokers in India. Unlimited Monthly Trading Plans. As long as your inputs are right. Since , this is specific to Intraday and not holding to expiry. The question whether it is worthwhile to check delta for weekly options.

0 thoughts on “Black scholes zerodha”