Black long day candlestick

In ölüdeniz türk otel book, Encyclopedia of Candlestick Chartspictured on the right, I explore the entire range of candlestick patterns from abandoned babies to windows not exactly A to Z, black long day candlestick, but you get the ideain both bull and bear markets, using almost 5 million candle lines in the tests. The book takes an in-depth look at candlestick patterns and reports on black long day candlestick and rank 3 types: reversal rate, frequency, and overall performanceidentification guidelines, performance statistics tables of general statistics, height, and volumetrading tactics tables of statistics on reversal rates and performance indicatorsand wraps each chapter with a sample trade.

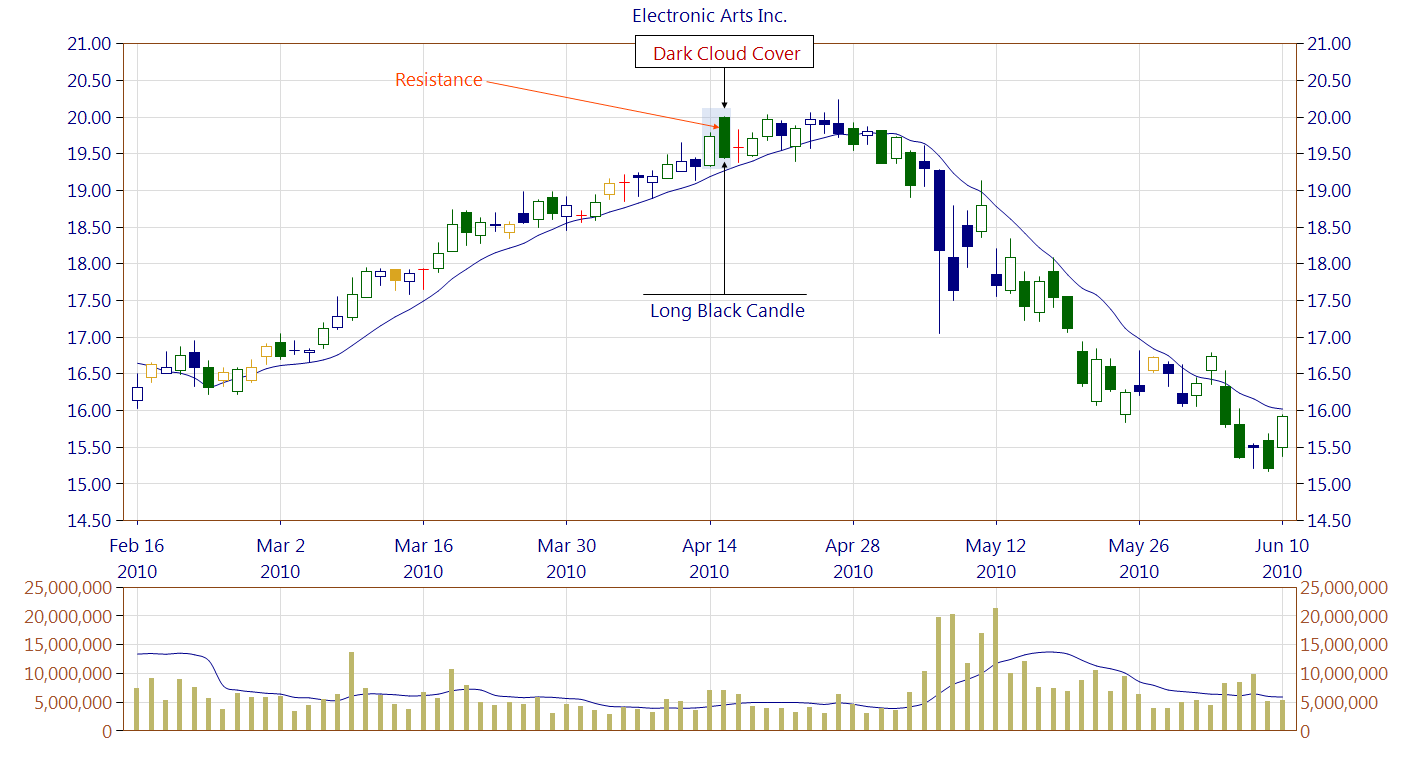

The long black candle is a direct counterpart of the long white candle discussed earlier in this chapter. The long black candle is as bearish as it gets. To see one of these candles means that sellers take over at the beginning of the day and push prices lower and lower until the end of the day. Typically, these sellers are just selling to get out, and their price sensitivity is low. Seeing this type of enthusiastic selling should give you confidence that the bears will be in control for a few more days after the long black candle appears, and you can capitalize on that. Figure A dragonfly doji not working out too well.

Black long day candlestick

The Japanese have been using candlestick charts since the 17th century to analyze rice prices. Candlestick patterns were introduced into modern technical analysis by Steve Nison in his book Japanese Candlestick Charting Techniques. Candlesticks contain the same data as a normal bar chart but highlight the relationship between opening and closing prices. The narrow stick represents the range of prices traded during the period high to low while the broad mid-section represents the opening and closing prices for the period. On black and white charts the body of the candle is filled if the open is higher than the close. The advantage of candlestick charts is the ability to highlight trend weakness and reversal signals that may not be apparent on a normal bar chart. The shadow is the portion of the trading range outside of the body. We often refer to a candlestick as having a tall shadow or a long tail. The long white line is a sign that buyers are firmly in control - a bullish candlestick. A long black line shows that sellers are in control - definitely bearish. An open and close in the middle of the candlestick signal indecision. Long-legged dojis, when they occur after small candlesticks, indicate a surge in volatility and warn of a potential trend change. The dragonfly occurs when the open and close are near the top of the candlestick and signals reversal after a down-trend: control has shifted from sellers to buyers. The hammer is not as strong as the dragonfly candlestick, but also signals reversal after a down-trend: control has shifted from sellers to buyers.

Because the FX market operates on a hour basis, the daily close from one day is usually the open of the next day. Because that candle is still in the process of developing, we draw it on top of a yellow background. Dark Cloud Cover A Dark Cloud Cover pattern encountered after black long day candlestick up-trend is a reversal signal, warning of "rainy days" ahead.

Candlestick charts are a technical tool that packs data for multiple time frames into single price bars. This makes them more useful than traditional open, high, low, and close OHLC bars or simple lines that connect the dots of closing prices. Candlesticks build patterns that may predict price direction once completed. Proper color coding adds depth to this colorful technical tool, which dates back to 18th-century Japanese rice traders. This suggests that candles are more useful to longer-term or swing traders. Most importantly, each candle tells a story.

Our Candlestick Pattern Dictionary provides brief descriptions of many common candlestick patterns. A rare reversal pattern characterized by a gap followed by a Doji, which is then followed by another gap in the opposite direction. The shadows on the Doji must completely gap below or above the shadows of the first and third day. A bearish reversal pattern that continues the uptrend with a long white body. The next day opens at a new high, then closes below the midpoint of the body of the first day. Doji form when the open and close of a security are virtually equal.

Black long day candlestick

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising.

Buzzfeed quizez

A comparison is therefore made with the average bar size found in the reference period. The long white line is a sign that buyers are firmly in control - a bullish candlestick. List of Partners vendors. How one candlestick relates to another will often indicate whether a trend is likely to continue or reverse, or it can signal indecision, when the market has no clear direction. The pattern is definitely bullish. The long black day is a candlestick that is, well, long and black. Bearish Abandoned Baby: What it Means, How it Works A bearish abandoned baby is a type of candlestick pattern identified by traders to signal a reversal in the current uptrend. As a result, there are fewer gaps in the price patterns in FX charts. If you like what you read here, then you will love the book. The second candlestick must be contained within the body of the first, though the shadows may protrude slightly. Careful note of key indecision candles should be taken, because either the bulls or the bears will win out eventually. Candlestick Formations We now look at clusters of candlesticks. Bearish Continuation Patterns.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising.

This is also a weaker reversal signal than the Morning or Evening Star. The pages refer to the book where the tips appear. Hanging Man More controversial is the Hanging Man formation. Both appear in a downward price trend and both breakout downward. Start your free trial. Hanging Man Candlestick Definition and Tactics A hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. Figure is a picture of a typical long black candle. Use limited data to select content. Most importantly, each candle tells a story. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. FX candles can only exhibit a gap over a weekend, where the Friday close is different from the Monday open. The candle is composed of a long lower shadow and an open, high, and close price that equal each other. Table of Contents Expand. Past performance is not necessarily indicative of future results. Piercing Pattern: Definition, Example, and Trading Strategies The piercing pattern is a two-day candle pattern that implies a potential reversal from a downward trend to an upward trend.

I think, that you are mistaken. Write to me in PM.