Best paying dividends asx

Our analysts weigh in on their future dividend prospects. In a recent article I tried to answer a question I hear frequently. Is it feasible to retire off dividends alone. In response to my article, I best paying dividends asx numerous success stories from retirees.

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers. Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation if any is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia.

Best paying dividends asx

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. With interest rates as high as they are and the best savings accounts delivering 5. The ASX bank shares and mining shares are well-known for delivering some of the highest dividend yields in the market year after year. But if you do some digging, you'll find other great dividend payers in other market sectors. Typically, the companies that will pay you the best dividend yields are the ASX large-cap shares. Most of them have been operating for decades, bringing in sustainably strong earnings every year. Let's look at which ASX large-cap shares are trading on the highest trailing dividend yields today. If you're using this data to research ASX dividend shares , just remember that trailing dividend yields represent last year's earnings as a percentage of today's share price. This is particularly the case with mining stocks, oil shares and any other stock associated with commodities. These companies negotiate the sale prices for their products based in large part on the going global market commodity price at the time. Commodity prices are entirely out of these companies' hands. When they're high, mining and oil shares are likely to earn more and pay higher dividends. When they're low, the reverse happens. Conversely, large non-commodity companies producing the same services or products year after year may have limited room for growth, and hence they may deliver very stable earnings and dividends.

ASX Market Report.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. The ASX financial shares include banks , insurers, and investment houses and plenty of them pay handsome dividends. So, let's look ahead and see how much passive income the experts predict these stocks will pay in FY For the purposes of this article, we're going to limit our research to ASX large-cap financial shares.

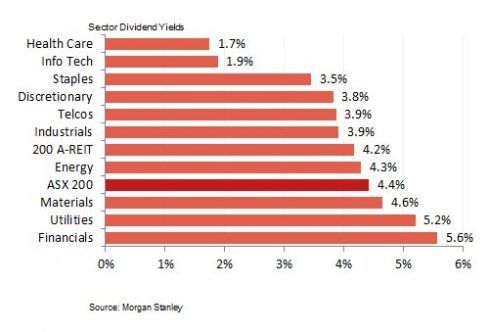

Our analysts weigh in on their future dividend prospects. In a recent article I tried to answer a question I hear frequently. Is it feasible to retire off dividends alone. In response to my article, I heard numerous success stories from retirees. These are real life examples of the premise of my article. You can retire off dividends. However, I looked at the risks of this income investing strategy and offered some suggestions. A focus of the article was the Australian share market and the advantages and disadvantages of building a portfolio heavily tilted toward Aussie shares. The advantage is obvious.

Best paying dividends asx

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers. Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation if any is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia. In comparing various financial products and services, we are unable to compare every provider in the market so our rankings do not constitute a comprehensive review of a particular sector. While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed. We make every effort to provide accurate and up-to-date information.

Tea stardew valley

While the dividend yield is significant, it's also closely tied to the volatile coal market, a factor for investors to consider due to its impact on the company's financial distributions. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers. Actual returns may vary based on the performance of the stocks or funds, market conditions, and other factors. Find cheap stock brokerage. The company's dividend yield stands at Prospective investors should consider whether the past year was an outlier or a signal that the footwear industry is one to watch into the future. Fiscal year was a bumper year for Woodside dividends but Taylor expects payments to drop over the next two years. He expects continued dividend growth in and All rights reserved. March 8, Sebastian Bowen.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More.

We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. On the other hand, dividend funds, which include exchange-traded funds ETFs and managed funds, provide a diversified investment vehicle comprising a basket of dividend-paying stocks. Yields calculated based on share prices at the time of writing A word of warning on trailing dividend yields If you're using this data to research ASX dividend shares , just remember that trailing dividend yields represent last year's earnings as a percentage of today's share price. Next, diversify your investments across different industries and sectors to minimise risk and create a well-rounded portfolio. Dividends can be one of the most important considerations for Australian investors, especially those who are looking to live off the income their shares provide. Spaceship US Investing. Top Stories. Related articles. The company upheld a consistent dividend payment in FY, with a full-year dividend matching the previous year at We used a proprietary algorithm to find the a list of ASX penny stocks that should be on your watchlist in US shares, ETFs. Its geographically diverse portfolio of properties includes growth markets across Australia. Trade over 45, shares and ETFs from Australia and 15 major global markets. APM is a multi-national human services provider based in Perth, Australia. View More A—Z List.

In my opinion you are not right. I can defend the position.

I am assured, what is it to me at all does not approach. Who else, what can prompt?

The excellent message))