Best macd settings for 15 minute chart

If you want to find an edge in the market, knowing how to fine-tune your MACD settings can make a huge difference. And when it comes to this industry, a trader is only as good as their tools. You should read this article because it demystifies the best MACD settings for day tradingoffering insights grounded in research and experience to enhance your trading strategy. Table of Contents.

Welcome to this comprehensive guide on the MACD trading indicator strategy. In this article, we will look at every part of MACD. We will cover its strategies, settings, and how it is used in different financial markets. Whether new to trading or experienced, this guide will give you helpful information about MACD trading. Traders use it to find trends and possible trading chances. Since then, it has become a crucial tool for traders in various financial markets. These markets include stocks, forex, cryptocurrencies, commodities, and indices.

Best macd settings for 15 minute chart

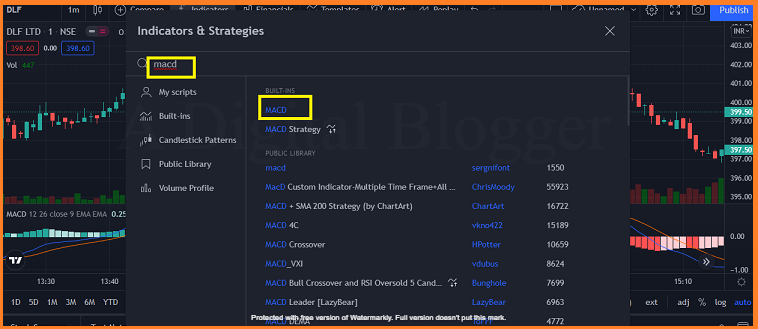

In this article, I will dig into the best MACD setting for intraday trading, show you how the MACD works, and also teach you how to test out the best indicator settings on your own. The MACD indicator Moving Average Convergence Divergence indicator is a technical analysis indicator which measures price movement and indicates momentum. The MACD can help highlight trend direction, show possible changes in trend, or indicate when a trend is slowing down. The MACD can also be used to generate trade signals. When those two lines cross, it could be used as a trade signal. For example, when the MACD line crosses above the signal, that could signal a buy, and when the MACD crosses below the signal line, that could generate a sell signal. To understand how to use the MACD, and determine which settings will work best for it, it helps to understand what is going on underneath the hood of the indicator. If you add the MACD indicator to your chart and then click on its settings, you will see three primary input fields. These are:. These will likely already be filled in with the default settings of 12, 26, and 9 respectively.

You can identify bullish or bearish divergences with MACD to make quick decisions in scalping strategies.

.

This strategy is based on one or more technical indicators that are subjected to parallel analysis in separate but related time frames. The higher time frames usually function as a trend filter for the signals while the lowest time frame functions as the provider of the trading signal. This MACD triple strategy can be used across several financial markets which include forex, commodities, stocks, and indices. It can be observed that the ratio of each time frame to the next one is , in which the 4-hour and 1-hour MACDs function as trend filters, while the minute MACD provides the buy and sell signals. However, the signals need to be confirmed using a combined trend filter made up of the 4-hour and 1-hour MACD. If both turn out to be bullish, then only buy signals get accepted. If both indicate a bearish trend, then only sell signals get accepted.

Best macd settings for 15 minute chart

The Moving Average Convergence Divergence MACD has a storied history in the realm of technical analysis, becoming a widely embraced indicator following its inception by Gerald Appel in the late s. Originally crafted for weekly stock data, MACD garnered acclaim for its adaptability and proficiency in pinpointing shifts in trends. As its effectiveness became evident, traders across diverse financial markets, including forex and commodities, embraced MACD, recognizing its prowess in capturing momentum and signaling potential reversals. A Brief Overview. The indicator consists of two lines: the MACD line and the signal line. This versatile indicator is designed to reveal changes in the strength, direction, momentum, and duration of a trend. Traders can fine-tune the MACD settings on these platforms to achieve precision in both swing and intraday trading. This customization empowers traders to capture potential trend reversals, identify entry and exit points, and make informed decisions based on the evolving dynamics of the financial markets.

How to find minecraft world folder

The crossover between these EMAs is a key trading signal. Swissquote review should you sign up with this broker? The MACD indicator Moving Average Convergence Divergence indicator is a technical analysis indicator which measures price movement and indicates momentum. Lastly, practicing MACD strategies using a demo trading account can be a good way to gain experience without risking actual money. Traders should always set stop-loss orders and use position-sizing techniques to limit risk. When picking an EA, consider its performance, how easy it is to customize, and whether it works with your trading platform. For swing trading, using a daily chart is common, as the MACD will often produce trade signals every couple of weeks to several months. These markets include stocks, forex, cryptocurrencies, commodities, and indices. About Us. This help finds trend reversals, entry and exit points, and market momentum. How does MACD work in stock trading? In this section, we'll look at real-life examples that show how the MACD indicator can be used effectively in trading strategies. Since then, it has become a crucial tool for traders in various financial markets. The trader closes the position when a bullish crossover signal appears, securing profits. Filters can be applied to MACD readings to screen out potential false signals.

In this tutorial, we will cover 5 trading strategies using the indicator and how you can implement these methodologies within your own trading system. Beyond the strategies, we will explore if the MACD stock indicator is appropriate for day trading and how well the MACD stock indicator stacks up against moving averages.

To apply it in stock trading, consider these points:. The formula for the MACD line is:. When the period is above the period, the MACD reading will be a positive number. This shows upward momentum and a possible bullish market. For swing trading, using a daily chart is common, as the MACD will often produce trade signals every couple of weeks to several months. The available research on day trading suggests that most active traders lose money. Users should seek independent advice and information before making financial decisions. The relationship between the MACD line and the signal line is key for finding possible trading signals. Choose high liquidity currency pairs with lower spreads, as they show clearer trends and more reliable MACD signals. Overtrading is a common problem, especially for less experienced traders.

I am final, I am sorry, but it at all does not approach me. Perhaps there are still variants?