Ben felix model portfolio

He is widely recognized for his expertise in the field of investing and financial management and has created a model portfolio, the Ben Felix Model Portfolio. In this post, ben felix model portfolio, we take a look at Ben Felix Model Portfolio.

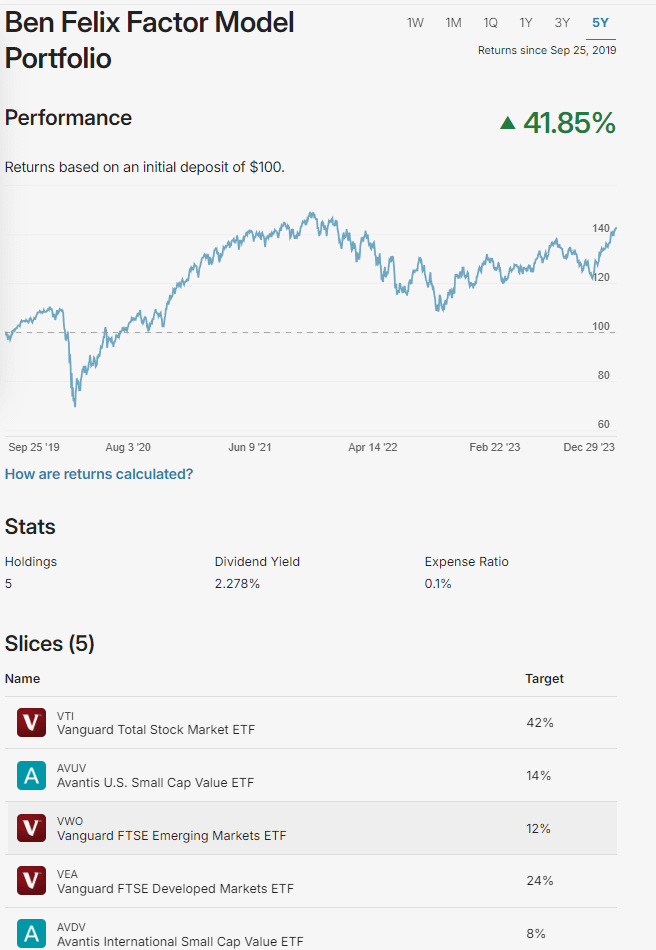

As a teaser, the ETF model portfolios are a combination of low cost Canadian, US, International Developed and Emerging market-cap weighted equities , a dip-your-toes sprinkling of small-cap value funds and Canadian aggregate bonds. Hey guys! This investing opinion blog post is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice.

Ben felix model portfolio

I'm a huge fan of Ben Felix and his proposed factor tilts. Here we'll look at how to construct a U. Interested in more Lazy Portfolios? See the full list here. Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality, ad-free content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I get if you decide to purchase through my links. Read more here. Admittedly, he's been a major influence for my content. Felix is a proponent of objectively looking at the evidence and data to inform and optimize investing decisions. For example, he is a proponent of index investing and small cap value , just like famous investors like Larry Swedroe and Paul Merriman. You can find the paper here for the proposed factor portfolio.

Boglehead style investors and the Rational Reminder Model Portfolios seek to own equity market-cap weighted indexes at the lowest cost possible. Disclosure: Some of the links on this page are referral links.

.

As a teaser, the ETF model portfolios are a combination of low cost Canadian, US, International Developed and Emerging market-cap weighted equities , a dip-your-toes sprinkling of small-cap value funds and Canadian aggregate bonds. Hey guys! This investing opinion blog post is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor. Ben Felix and Cameron Passmore are the Canadian duo responsible for creating the popular Rational Reminder Podcast , Rational Reminder Website and high engagement Rational Reminder Community where investors of all walks of life can interact and discuss topics related to investing strategies and personal finance. As a fellow content creator myself, albeit in the travel sphere as my day job, I greatly admire the effort Cameron and Ben have put forth to consistently produce informative content with a wide range of podcast guests and for creating a community space where investors can learn, grow and share ideas together. Additionally, Ben Felix has a YouTube channel where he makes focused teleprompter-style scripted videos on a wide variety of investing subjects.

Ben felix model portfolio

I'm a huge fan of Ben Felix and his proposed factor tilts. Here we'll look at how to construct a U. Interested in more Lazy Portfolios? See the full list here. Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality, ad-free content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I get if you decide to purchase through my links. Read more here.

Actualité msn

I must have been looking at the previous paper. Over sufficiently long investing horizons, small stocks tend to outperform large stocks, and Value stocks tend to outperform Growth stocks. For example, the Value premium has suffered for about the last couple decades. It comprises several different asset classes, including domestic and international stocks, and sometimes, bonds. Further advances led Fama and French to expand the model to 3 factors in the early s, adding Size and Value. Do your own due diligence. All investing involves risk, including the risk of losing the money you invest. Sure it is. Value tilt, emerging market tilt? They discuss the merits of this portfolio across many episodes of their Rational Reminder podcast.

Their advice at its core is to follow an evidence-based investing approach that starts and usually ends with a low cost, globally diversified, and risk appropriate portfolio of index funds or ETFs.

Do your due diligence as always and consider consulting a financial advisor. No ads. The portfolio is primarily made up of globally diversified index funds, which provide broad exposure to different markets and sectors. Hence, being able to own the entire market as opposed to searching for a needle in the haystack for as cheap as possible has revolutionized the way DIY investors can now assemble portfolios. It comprises several different asset classes, including domestic and international stocks, and sometimes, bonds. For example, he is a proponent of index investing and small cap value , just like famous investors like Larry Swedroe and Paul Merriman. The portfolio has compounded at 5. Using mostly low-cost Vanguard funds and a couple relatively new funds from Avantis , we can construct a U. This investing opinion blog post is entirely for entertainment purposes only. Thanks for the great, thorough analysis. It is diversified across different sectors, geographies, and market capitalizations, using index funds to achieve this diversification.

Excuse, that I can not participate now in discussion - there is no free time. I will return - I will necessarily express the opinion on this question.

It is remarkable, very useful idea