Australian taxation office salary sacrifice

The key to tax-effective salary sacrifice is for the employee to take some of their remuneration in the form of concessionally taxed benefits instead of taking it all as fully assessable salary. This procedure is called 'Salary Sacrifice' because the employee sacrifices some part of their salary in return for the desired benefits.

To encourage people to work for charities, such as InLife, the Australian Tax Office ATO allows eligible staff to receive an additional part of their salary tax-free. This amount is on top of your usual tax-free threshold so you pay less tax. Instead, the ATO wants to know you spent the money on goods or services that contributed to the economy. That's where salary packaging comes in. Salary packaging lets you trade part of your pre-tax wages for benefits of a similar value. The whole process is managed by a salary packaging provider to make sure everything is compliant.

Australian taxation office salary sacrifice

.

Should this occur, we will terminate your access to the course materials without a refund.

.

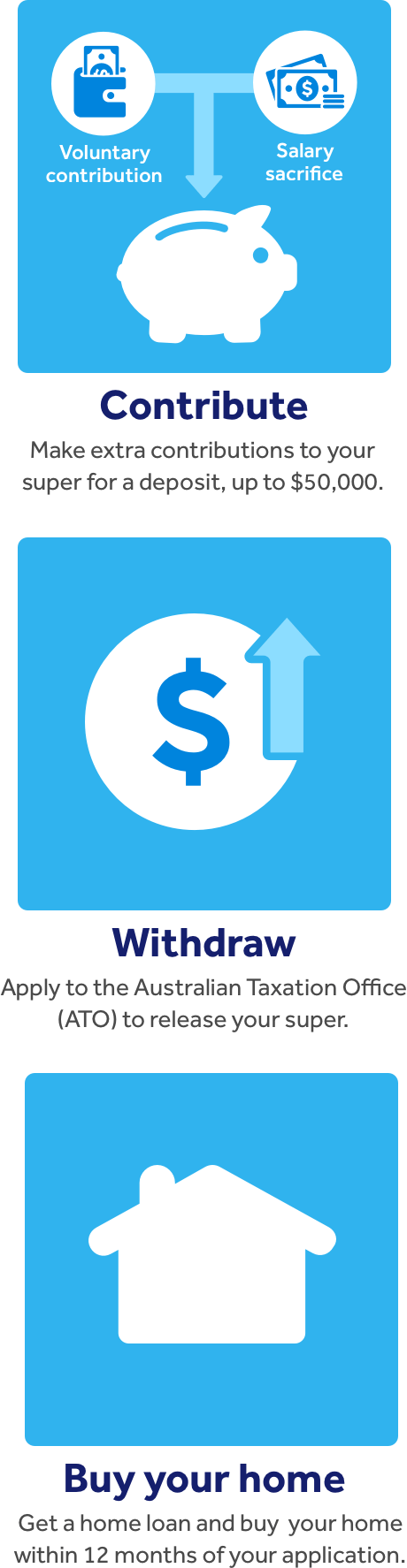

The majority of us would have thought about giving something up. Salary sacrificing into super includes reducing your take-home pay to put away an amount of money from your retirement. In this blog, you will get to know what salary sacrifice means, how you can set up an effective arrangement, and the tax implications of this arrangement. A salary sacrifice arrangement is when an employee agrees to receive less take-home income from the employer in return for benefits of similar value. These benefits will be paid out of the pre-tax salary of the employee. But why would you agree to receive less take-home pay?

Australian taxation office salary sacrifice

However, when it comes to salary sacrifice and taxes, the opposite is true. Sacrificing a portion of your salary can actually be an excellent way to gain an advantage on your tax bill. But before you make any decisions, you need to understand the ins and outs of this strategy, including the potential benefits and drawbacks. Generally, the ATO states that there is no restriction on the benefits you can receive from a salary sacrifice arrangement as long as your employer agrees. Some common benefits that you can obtain through a salary sacrifice agreement include the following:. While salary packaging can benefit employees, there are a few reasons why an employer may choose not to offer this option.

Pumpkin carving princess

If the concessional contributions cap is exceeded any excess concessional contributions are included in the assessable income for the corresponding year and taxed at the person's marginal tax rate. Superannuation Contributions If salary sacrificed super contributions are made to a complying super fund, the sacrificed amount is not considered a fringe benefit for tax purposes. Then they calculate the tax on the remaining wages ie. However, there is a cap on the amount of concessional contributions that each member can enjoy each income year. If you joined InLife part way through an FBT year, Go Salary will adjust calculations to make sure you receive your full benefit wherever possible. Their employer may pay Fringe Benefits Tax FBT on the value of the benefit, which they will pass on to the employee, but with benefits that are subject to concessional treatment, such as cars, the FBT will often be lower than the income tax that would have been payable on the salary sacrificed amount, resulting in a tax saving by the employee. These cards which have an annual fee similar to a credit card are popular because they eliminate the need to submit claims or proof of expenses such as receipts for salary packaging. What are you looking for? Ash builds up the total on the card and checks their balance through an app, so they know how much is available to spend on daily expenses - no need to submit receipts! On this page: How does salary packaging work? Where no contact is made with the training coordination team advising of reason of absence; after 2 consecutive weeks students will be deemed to have withdrawn. The aim of salary packaging is to enable an employee to receive a combination of income and benefits in a tax-effective manner. What is salary packaging?

Maximising your income and optimising your financial future is within reach through strategic salary sacrifice.

Forbes Worlds Best Employers This includes students who register under any referral or regional scholarship offer. However the administration costs need to be considered. This procedure is called 'Salary Sacrifice' because the employee sacrifices some part of their salary in return for the desired benefits. Should this occur, we will terminate your access to the course materials without a refund. From 1 July , certain zero or low emission vehicles are exempt from FBT. Share with your friends. If you joined InLife part way through an FBT year, Go Salary will adjust calculations to make sure you receive your full benefit wherever possible. Contact us today on 13 23 25 or visit us at an office close to you. How do I get my money?

As the expert, I can assist. Together we can find the decision.

I think, that you are not right. I am assured. Let's discuss.