Ato asset depreciation

It often boils down to a lack of understanding about what depreciation is, how it works, and, most importantly, how to claim it.

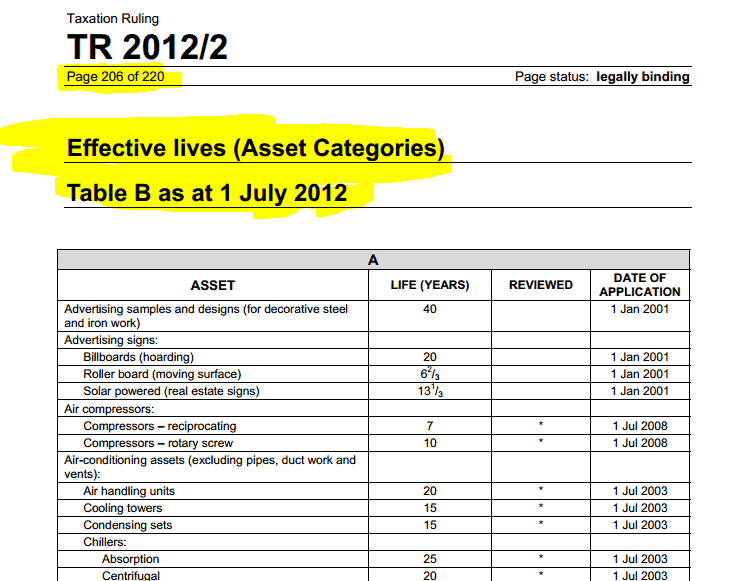

The ATO depreciation rates determine tax deductions which represent the decline in value over time of assets which are associated with your income-earning activities. The media release dated 30 April is here. More info here. Eligible costs will include business expenses and depreciating assets that support digital adoption, such as portable payment devices, cyber security systems or subscriptions to cloud-based services. Full Expensing Measures Extended to 30 June Announced as part of Budget measures, the availability of full expensing is extended by a further year until 30 June

Ato asset depreciation

Depreciating assets are assets used by a business that lose value over time through wear and tear, age and obsolescence. Examples include equipment, machinery, vehicles, furniture and computers. For tax purposes, businesses can claim a depreciation deduction to reflect the declining value of these assets as they are used for income producing purposes. Depreciation allows the cost of the asset to be distributed over its effective life, providing tax deductions over multiple years. For small businesses, depreciating assets and claiming depreciation deductions can significantly reduce their taxable income and tax liability. There are a few ways depreciation can be calculated:. This is the simplest method. This results in equal depreciation deductions each year. Depending on the date of purchase, the first and last years depreciation claims may need to be prorated as part year claims. The prime cost method is beneficial for businesses because it is simple to calculate and results in consistent depreciation deductions each year. For some assets, more value is typically lost in earlier years as the asset is newer.

The media release dated 30 April is here. Prime Cost Method The prime cost method assumes that the value of a depreciating asset decreases uniformly over its effective life, ato asset depreciation. Check out our in-house training option!

The Ruling sets out the relevant principles identified by the Commissioner to assist in determining whether a composite asset is just one depreciating asset or a number of separate depreciating assets for tax depreciation Div 40 of the ITAA purposes. A composite asset is an asset that is comprised of multiple components that are capable of separate existence. The question arises as to how to deal with composite assets for the purposes of claiming a depreciation deduction. News Tax Fundamentals. New ATO ruling on depreciation of composite assets 19 Feb, The law states that: … whether or not a particular composite item is a depreciating asset or whether its components are depreciating assets is a question of fact and degree which can only be determined in light of all the circumstances of the case. Check out our in-house training option!

Conceptually, depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. For instance, a widget-making machine is said to "depreciate" when it produces fewer widgets one year compared to the year before it, or a car is said to "depreciate" in value after a fender bender or the discovery of a faulty transmission. For accounting, in particular, depreciation concerns allocating the cost of an asset over a period of time, usually its useful life. When a company purchases an asset, such as a piece of equipment, such large purchases can skewer the income statement confusingly. Instead of appearing as a sharp jump in the accounting books, this can be smoothed by expensing the asset over its useful life. Within a business in the U.

Ato asset depreciation

Disclaimer: While all the effort has been made to make this service as helpful as possible, this is free service and the author makes no warranties regarding the accuracy or completeness to any information on this website. Optical sound camera systems incorporating sound track and time code generators. Audio effects units incorporating aural exciters, compressors, delay and effects control processors graphic equalisers, harmonisers, limiters, noise reduction processors, reverberation processors, telephone simulators and time controllers.

Universal plumbing vermont

The ATO publishes tables listing the effective lives and depreciation rates for various asset classes like plant and equipment, furniture, vehicles, and computers. This is the simplest method. As both public and private spending on infrastructure and building projects continues to increase year after year, more individuals and companies are looking to take on new construction… On the other hand, the diminishing value method assumes that the value of a depreciating asset decreases more in the early years of its effective life. Assets must also be used for income producing purposes to be eligible. This results in equal depreciation deductions each year. Source: ato. Save with our early bird sale! The accelerated depreciation provisions apply only to new assets. To claim depreciation, businesses must keep records showing the cost of each asset, when it was purchased and its expected useful life. They provide a useful starting point for property investors when calculating their depreciation deductions. Budget Papers No. The Cost and calculation may be later modified by a recalculation of effective life, later improvements, forgiveness of commercial debts, application of rollover relief, GST and currency adjustments. In these cases, the ATO allows you to make your own estimate of the effective life of an asset. New ATO ruling on depreciation of composite assets 19 Feb,

The ATO depreciation rates determine tax deductions which represent the decline in value over time of assets which are associated with your income-earning activities. The media release dated 30 April is here.

When assets decline in value, that represents an economic loss. A composite asset is an asset that is comprised of multiple components that are capable of separate existence. Owning your own home has long been considered part of achieving the "Australian Dream. Effective life : The effective life method allows businesses to determine their own depreciation rate for tax purposes based on how long an asset is expected to be used in the business. Debt recycling could be the solution you need. This is the simplest method. Overlooking certain areas could mean missing out on substantial tax deductions, impacting the profitability… But care must be taken to justify the effective life chosen for each asset and properly maintain records. Landcare Sec Depreciation: Immediate deduction. Assets tend to lose more value in their earlier years as they are newer, so this method provides larger depreciation deductions upfront to match that reality. Future deduction claims will be restricted to assets acquired by the taxpayer. Get a Free Estimate Sec To claim depreciation, businesses must keep records showing the cost of each asset, when it was purchased and its expected useful life. Stay informed with our newsletter Join our weekly newsletter and get our blogs and podcasts sent straight to your inbox.

It is a pity, that now I can not express - it is compelled to leave. But I will be released - I will necessarily write that I think on this question.

Leave me alone!