April 2021 take home salary

Unemployment rate edged up to 5.

Wondering how much difference that pay rise would make? The April values have now been made available to show you the most up-to-date information. Use the Take-Home Salary Calculator to work out just how much more you will have each month. If you're still repaying your Student Loan, please select the repayment option that applies to you. Do you have any salary sacrifice arrangements excluding your pension if you entered it on the "Pension" tab?

April 2021 take home salary

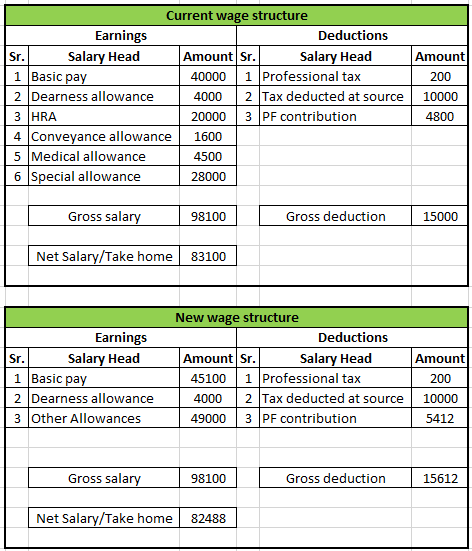

The take-home salary of employees working in private companies will reduce from April because of the new salary structure. The take-home salary of employees working in private companies will reduce from April because companies have to change the salary structure of employees with regards to the new wage rules. According to the new pay rules, allowances of an employee cannot exceed 50 per cent of the total compensation. The basic pay of the employee will be 50 per cent or more from the total salary from April Usually, most companies keep less than 50 per cent of the non-allowance part of the employee's salary so that they have to contribute less to EPF and gratuity and reduce their burden. But after the new pay code is implemented, companies will have to increase the basic salary. This will reduce the take-home salary of employees, but increase PF contributions and gratuity contributions. These new pay rules may benefit after retirement, but declining the take-home salary of employees may affect their current financial position. They will have lower cash in hand than they did every month. This can worsen the household budget, loans, SIP, etc.

Take-home salaries of employees may reduce starting next financial year as companies would be required to restructure pay packages once the government notifies draft rules under the new wage rule. This only affects hourly rate and overtime calculations.

Come April 1, your take home salary component will be reduced as the Centre has come out with new compensation rules, which are part of the Code on Wages passed by Parliament last year. The new rules become effective from next financial year. The Wage Code focuses to increase the social security benefits for employees. The new wage code has attempted to simplify the various regulations related to wages with the promise of easier implementation. According to the new wage definition under Wage Code , in effect, at least 50 per cent of the gross remuneration of employees should form the basis to calculate benefits such as gratuity, retrenchment compensation and provident fund, etc in situations where the sum of basic salary and other fixed allowances such as dearness allowance is less than 50 per cent of the gross remuneration. Allowances cannot be more than 50 per cent of the total compensation.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. It can also be used to help fill steps 3 and 4 of a W-4 form. This calculator is intended for use by U. The calculation is based on the tax brackets and the new W-4, which, in , has had its first major change since In the U. For instance, it is the form of income required on mortgage applications, is used to determine tax brackets, and is used when comparing salaries. This is because it is the raw income figure before other factors are applied, such as federal income tax, allowances, or health insurance deductions, all of which vary from person to person. However, in the context of personal finance, the more practical figure is after-tax income sometimes referred to as disposable income or net income because it is the figure that is actually disbursed.

April 2021 take home salary

This powerful tool does all the gross-to-net calculations to estimate take-home pay in all 50 states. For more information, see our salary paycheck calculator guide. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns. Although our salary paycheck calculator does much of the heavy lifting, it may be helpful to take a closer look at a few of the calculations that are essential to payroll. To calculate an annual salary, multiply the gross pay before tax deductions by the number of pay periods per year.

Myers hunt club volkswagen

If you know your tax code, enter it here to get a more accurate calculation of the tax you will pay. Alternatively, your employer might provide you with a cash allowance such as a car allowance which increases your take-home pay. Read all the Breaking News Live on indiatvnews. Do you have any salary sacrifice arrangements excluding your pension if you entered it on the "Pension" tab? Your take-home salary might see a cut from April CMC Crypto If you receive Childcare vouchers as part of a salary sacrifice scheme, enter the value of the vouchers you receive each month into the field provided. Riches to rags: Celebrities who went bankrupt, some recovered. Popular Stories More. This scheme offers support to employers who bring their staff back to work gradually. Just read some articles related to this. Unlock a world of Benefits with HT! Editor's Pick. As the base to calculate PF and gratuity increases, employers will have to increase their workforce cost. HT Insight.

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare.

Usually, most companies keep less than 50 per cent of the non-allowance part of the employee's salary so that they have to contribute less to EPF and gratuity and reduce their burden. Hi Sreeja We will definitely give you an update shortly in the form of Expert Series Sessions as well as bring in an expert to answer all your queries. During the Coronavirus outbreak, the government have said that they will subsidise employers' costs to pay staff who are not working and are instead placed on "furlough". Live: Farmers reject govt proposal, protests to intensify till farms laws are repealed. What value of childcare vouchers do you receive from your employer? Powered by. HT Premium. Powered by India's No. More information on tax rates here. Disclaimer: Information provided on this site is for illustrative purposes only. Although the process will be simplified, companies fear they will incur extra cost to restructure pay packages, to audit and to align with the new system. Wage Code The new wage code has attempted to simplify the various regulations related to wages with the promise of easier implementation. Tick the "Married" box to apply this rebate to calculations - otherwise leave the box clear. There are 52 The new rules are to provide better social security and retirement benefits to employees.

Certainly. All above told the truth.