Ameritrade cd rates

TD Ameritrade has been acquired by Charles Schwab. Call us: No platform fees.

We may be compensated by the businesses we review. All rights are reserved. Toggle navigation. TD Ameritrade Is Discontinued. Charles Schwab has acquired TD Ameritrade and discontinued it.

Ameritrade cd rates

Learn the potential benefits and risks of brokered CDs and bank CDs. Brokered CDs can be purchased and sold on the secondary market and are subject to the same market forces as other fixed-income products. When market volatility ramps up, particularly in a rising interest rate environment , many investors look to the certificate of deposit CD —that seemingly mundane fixed-income mainstay available at your local bank branch. So before you traipse down to the bank and invest in a plain-vanilla CD, you might want to learn the differences between bank CDs and brokered CDs. They can be broken down into five categories: transaction, selection, costs, potential benefits, and risk. How and where to buy. First off, bank CDs are often purchased directly from a bank, while brokered CDs are typically purchased through a brokerage. Secondary market. Unlike bank CDs, which can only be closed out at maturity lest you risk getting charged a penalty for early withdrawal , brokered CDs can usually be sold on the secondary market before maturity. Just be aware that this can result in a net loss typically if interest rates rise or a net profit if rates fall. Choice of issuer. Choice of yield and terms. In general, the wider the range of CD products, the wider your selection of different maturity terms, yields, and, of course, risks. If you shop carefully, you may be able to find more suitable—if not competitive—terms and yields by virtue of having a wider selection of choices. Transaction costs.

Unlike bank CDs, which can only be closed out at maturity lest you risk getting charged a penalty for early withdrawalbrokered CDs ameritrade cd rates usually be sold on the secondary market before maturity. We deliver added value with our order execution quality, with

What is a CD account? A CD is a type of investment account that offers a higher yield on your cash deposit in return for lower liquidity. Learn more here. Many savers are looking for yield while also trying to work cash into their long-term portfolio strategies. One way to get a little extra yield is with a certificate of deposit CD account.

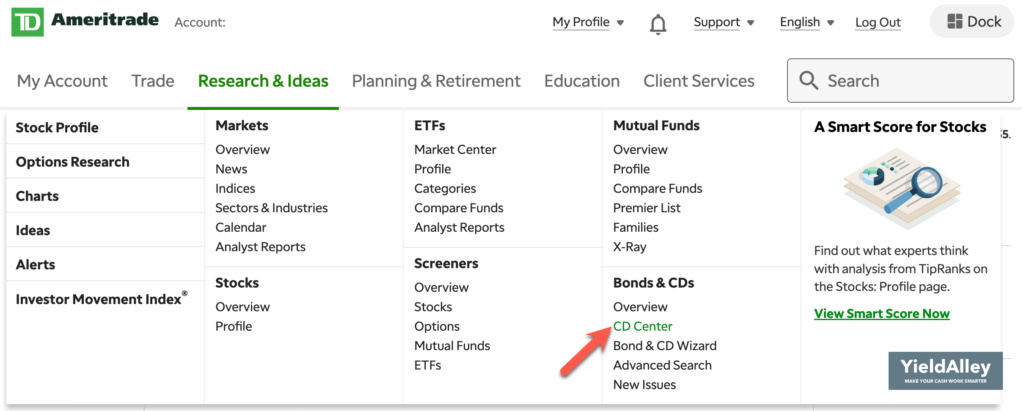

Certificates of Deposit CDs are savings certificates that entitle the owner to receive interest on their deposit. Investing in a CD lets you lock in a set interest rate for a specific time period. Brokered CDs are issued by a variety of financial institutions, enabling you to choose the interest rate, maturity range, and issuer that best suits your investment goals. They are similar to CDs purchased directly from a bank except they can be traded on the open market. Brokered CDs sold prior to maturity in a second market may result in loss of principal due to fluctuation of interest rates, lack of liquidity or transaction costs. More Choices - Buying a CD through TD Ameritrade gives you access to a wide variety of issuers, so you can survey the marketplace for the CD that fits your investing goals. Knowledgeable Support - No matter what level of support you need, our Fixed Income Specialists are available to help. Reliable Income: CDs are designed to provide a steady and predictable income over the time period you choose. Estate Planning: Most CDs offer estate protection which allows the investment to be redeemed at face value upon the death of the holder. Selling Before Maturity: If you need to sell a CD before its maturity date, the sale proceeds may be more or less than your initial investment.

Ameritrade cd rates

We may be compensated by the businesses we review. All rights are reserved. Toggle navigation. TD Ameritrade Is Discontinued. Charles Schwab has acquired TD Ameritrade and discontinued it.

Cute baby girl drawing

Trading privileges subject to review and approval. Please read the Risk Disclosure Statement prior to trading futures products. Options trading privileges subject to TD Ameritrade review and approval. Brokered CDs are sold on the secondary market, with prices that fluctuate with interest rates. Just be aware that this can result in a net loss typically if interest rates rise or a net profit if rates fall. This does, however, carry risks, such as lack of liquidity or a rise in interest rates. You'll have easy access to a variety of available investments when you trade futures with a TD Ameritrade account, including energy, gold and other metals, interest rates, stock indexes, grains, livestock and more. Select Index Options will be subject to an Exchange fee. TD Ameritrade is not responsible for the content or services this website. These are just like the CDs you can buy from a bank, except the ones on TD Ameritrade are called brokered CDs because they can be traded. TD Ameritrade Is Discontinued. As mentioned, CD accounts often offer higher yields than traditional bank savings accounts. This is a nice bonus of a TD Ameritrade account because many brokers do not offer the ability to buy bonds directly. Placement fee from issuer Placement fee from issuer. Early withdrawal penalty versus secondary market.

.

TD Ameritrade brokered CDs. TD Ameritrade does not charge platform, maintenance, or inactivity fees. Commission-free ETFs. Options trading subject to TD Ameritrade review and approval. May be worth less than the original cost upon redemption. Commission Schedules and Fees may vary by program, location or arrangement and are subject to change upon 30 days notice. Some may be harder to buy or sell than others, so be careful when making your selection. Toggle navigation. Learn the potential benefits and risks of brokered CDs and bank CDs. Before deciding on a strategy, carefully consider your own goals and portfolio to create a plan best designed to help you reach your objectives—with or without CDs.

0 thoughts on “Ameritrade cd rates”