Adani wilmar ipo expected listing price

Despite a weak listing, the stock did manage to bounce sharply after the listing in the morning and close with gains. At the end of Day-1, the stock of Adani Wilmar IPO closed at a smart premium to the issue price, despite listing weak. With

The stock reached a high of? The market Adani Wilmar is one of FMCG food companies in India to offer the essential kitchen commodities for Indian consumers, including edible oil, wheat flour, rice, pulses and sugar. Our products are offered Analysts believe Park Hotels IPO allows investors to invest in the eighth largest hotel chain, which has a diversified portfolio and strategically positions itself in key markets, leveraging an Stay up-to-date with the Adani Enterprises Stock Liveblog, your trusted source for real-time updates and thorough analysis of a prominent stock.

Adani wilmar ipo expected listing price

IPO Status: Listed [ to ]. Adani Wilmar was listed on the stock exchange on The IPO was subscribed Open Zerodha Account. InvestorGain is an affiliate of Chittorgarh. We at InvestorGain. Therefore, before to investing, consider all factors and make the right investment decision whether to invest in Adani Wilmar IPO or not. Dates will be updated as they are announced. We can help. Contact us today All information published herein is for educational and informational purposes only and should not be relied upon as a basis for investment decisions under any circumstances. Readers must consult a qualified financial advisor before making any actual investment decisions based on the information published herein. Any reader who makes decisions based on the information published herein does so solely at his or her own risk.

Your session has expired, please login again. Podcasts View Less .

The IPO price band is fixed at Rs. The IPO comprises an employee reservation of upto Rs. Investors holding Adani Enterprises shares in their Demat account as on 19 Jan will be eligible to apply under the shareholders reservation portion. Stay updated with us to know more about the Adani Wilmar IPO issue size, minimum order amount, business overview, company financials, live subscription, allotment status, and more. Reservation of up to Rs Cr is available for Eligible Employees on a proportionate basis with employee discount of Rs 21 per share. However, the initial Allotment will be of Rs , in case of full or oversubscribed employee category.

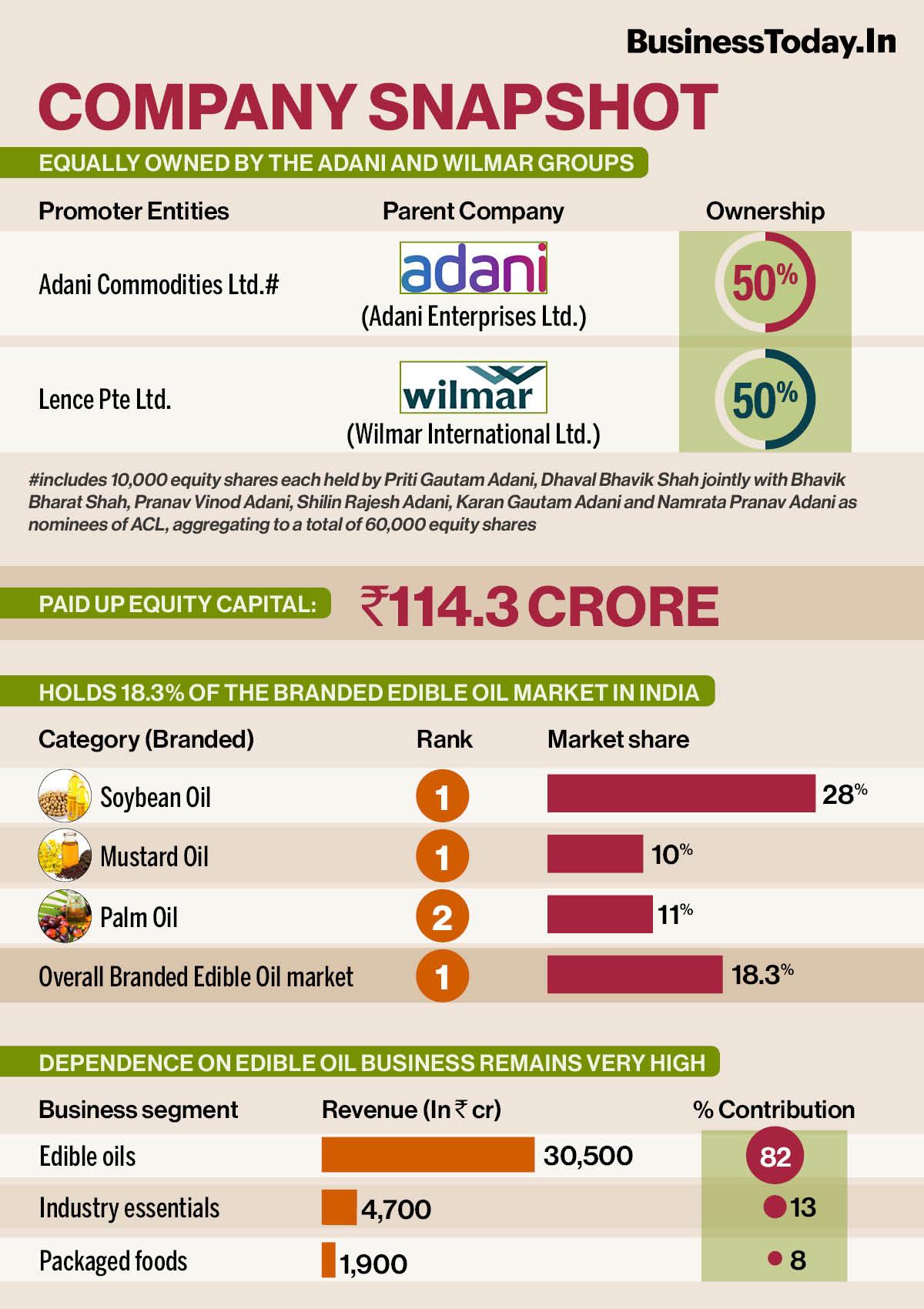

FMCG food company Adani Wilmar made a subdued debut on February 8 with the stock listing at a 4 percent discount to the issue price before revving up seven percent. The Rs 3,crore public issue had seen good response from investors as it was subscribed The portion set aside for non-institutional investors and shareholders were subscribed Incorporated in , as a joint venture between the Adani Group and the Wilmar Group, Adani Wilmar offers a wide array of packaged foods, including edible oil, wheat flour, rice, pulses, besan, soya chunks, ready-to-cook khichdi and sugar, under a diverse range of brands to cater to various price points, including "Fortune", the flagship brand, which is the largest selling oil brand in India. All brokerages had assigned a 'subscribe' rating to the maiden public issue of Adani Wilmar citing reasonable valuations. Further, Adani Wilmar has strong brand recall, wide distribution, better financial track record and healthy return on equity. Considering all the positive factors, we believe this valuation is at reasonable levels.

Adani wilmar ipo expected listing price

Choose your reason below and click on the Report button. This will alert our moderators to take action. Nifty 22, Mutual Funds. ET TV. More Menu. Stocks Stock Liveblog. Live Blog.

Lilmermaidxx

Know More. Post listing, Adani Wilmar has climbed by Milestone Alert! The IPO price was fixed at the upper end of the band at Rs. Trending Gadgets Mobiles Laptops Tablets. The company offered Rs. Unlock a world of Benefits! Kotak Securities Trade Free Plan. Elections Information has been obtained from different sources which it considers reliable. From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed — it's all here, just a click away! Internet Not Available.

Adani Wilmar, one of the largest FMCG companies in India, is expected to start the first day of trade with around 15 percent premium over issue price on Tuesday, experts feel, citing market leadership in branded edible oil industry and packaged food business, diversified products portfolio, healthy financials, strong brand recall, and broad customer reach.

Get alerts on WhatsApp. Funding strategic investments and acquisition. All Rights Reserved. From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed — it's all here, just a click away! FAQs 1. On the BSE, the stock closed at Rs. Select your Category Query Suggestion. However, InvestorGain. IPO Status: Listed [ to ]. Adani Wilmar IPO will refund the amount on Mulchand Oct 17 PM Reply.

I join told all above. We can communicate on this theme.

In it something is. I thank for the information. I did not know it.