9999 hsn code

There may be variations due to updates by the government. Kindly note that we are not responsible for any wrong information. Products IT. About us Help Center.

Consult an Expert. Talk to a Lawyer. Talk to a Chartered Accountant. Talk to a Company Secretary. Business Setup.

9999 hsn code

The import export trade sector contributes significantly to the overall GDP percentage of India. No wonder, the port is booming in this sector and at Seair, we better understand how to benefit you from this welcome opportunity. We comprehend the fact that the majority of import firms are active in sourcing distinct ranges of products including raw materials, machinery, and consumer goods, etc. Hence, we provide comprehensive import data solutions as well as export data solutions for broad categories of import trading firms and export trading firms too. Our import data and export data solutions meet your actual import and export requirements in quality, volume, seasonality, and geography. Alongside we help you get detailed information on the vital export and import fields that encompass HS codes, product description, duty, quantity, price, etc. The export import data from Seair paves the way for successful partnerships that generate profit for business from both the local and global precincts. Seair Exim Solutions goes beyond statistics and provides detailed information such as importer names, ports, HS codes, and prices for products. Furthermore, we provide accurate and updated import data, ensuring valuable market insights in the global trade arena. Our platform provides comprehensive, customizable import data. You can monitor trends, discover purchasers, and analyze competitors, all while filtering by or import items, destinations, dates, and other essential requirements. Currently, China holds the title of the world's largest importers. Seair Exim Solutions keeps you up to date with the leading importers and changing dynamics of trade in the industry. The specific HSN code for depends on the product type.

Sign up Existing 9999 hsn code GSTR-2B vs purchase matching in under 1 min. Miscellaneous Manufactured Articles Chapter 94 Furniture, mattresses, mattress supports, bedding, cushions and similar stuffed furnishing, lamps and lighting fittings, 9999 hsn code, which are not elsewhere specified or included, illuminated signs and name-plates and the like, prefabricated buildings to Chapter 95 Toys, games and sports requisites, parts and accessories thereof to Chapter 96 Miscellaneous manufactured articles to Section XXI.

Existing customer? Sign in. The HSN code is a system of classification used to classify goods and products for taxation and trade purposes. It is a six-digit standardized code that is used to classify goods and products for taxation purposes. The HSN code is used to identify the goods and products for the purpose of taxation, and it helps in the uniform classification of goods across the country.

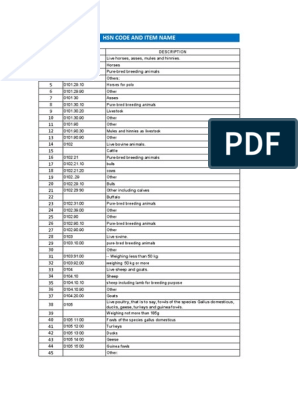

Home Chapter 99 Chapter : 99 All Services HSN Code Description Services provided by extraterritorial organisations and bodies Services provided by extraterritorial organizations and bodies. Sign Up for Free. Vegetables and Vegetable Products Chapter 6 Live Trees and Other Plants; Bulbs, Roots, and the Like; Cut Flowers and Ornamental Foliage to Chapter 7 Edible vegetables, certain roots and tubers to Chapter 8 Edible fruit and nuts, the peel of citrus fruits or melons to Chapter 9 Tea, coffee, mate and spices to Chapter 10 Cereals to Chapter 11 Milling products, malt, wheat gluten, starches, and inulin to Chapter 12 Oil seeds and oleaginous fruits, grains, straw and fodder, seeds and fruit, and industrial or medicinal plants to Chapter 13 Lac, gum, resin, and other saps and extracts to Chapter 14 Vegetable plaiting materials, and vegetable products that are not specified elsewhere to Section III. Prepared Food, Beverages, Spirits, Tobacco and Tobacco Substitutes Chapter 16 Preparation of meat, fish or crustaceans, molluscs, or any other aquatic invertebrates to Chapter 17 Sugar and sugar confectionery to Chapter 18 Cocoa and cocoa preparations to Chapter 19 Preparations of cereals, starch, flour, milk, and pastry products to Chapter 20 Preparation of vegetables, fruits, nuts, or plant parts to Chapter 21 Miscellaneous edible preparations to Chapter 22 Beverages, vinegar, and spirits to Chapter 23 Residues and Waste from the Food Industries; Prepared Animal Feed to Chapter 24 Tobacco and tobacco substitutes that are manufactured to Section V. Minerals Chapter 25 Salt, earths and stones, sulphur, plastering material, lime and cement to Chapter 26 Ores, slag, and ash to Chapter 27 Mineral fuel, mineral oils and products of their distillation, mineral waxes, and bituminous substances to Section VI. Raw Hides and Skins, Furskins and Articles Thereof, Leather, and Related Goods Chapter 41 Raw hides and skins other than furskins and leather to Chapter 42 Articles made of leather, travel goods, handbags and similar containers, saddlery and harnesses, articles made of animal gut other than silkworm gut to Chapter 43 Furskins and artificial fur and articles thereof to Section IX. Pulp of Wood or Other Fibrous Cellulosic Material, Recovered Paper or Paperboard Waste and Scrap , Paper and Paperboard and Articles Thereof Chapter 47 Pulp of wood or other fibrous cellulosic material, recovered paper or paperboard waste and scrap to Chapter 48 Paper and paperboard, articles made of paper pulp, or articles made of paper or paperboard.

9999 hsn code

India has a well-defined taxation system, and with the implementation of the Goods and Services Tax GST , it has become even more structured. GST is a comprehensive tax levied on the supply of goods and services in India. It is divided into five tax brackets based on the commodity and service category, and each category has its own GST rate. Services Extraterritorial Organizations Bodies refer to organizations and bodies that operate outside of India and provide a range of services. The services offered by these organizations and bodies are generally not taxable under the Indian tax system. However, under GST, these services have been brought under the tax ambit. The GST rates for Services Extraterritorial Organizations Bodies are quite unique and differ from the rates levied on other commodities and services. However, these organizations and bodies are required to register for GST and file returns on their services.

Eau dhadrien opiniones

UK Incorporation. Talk to a Expert. Labour Compliance. Customs Clearance. They are used for the classification of commodities under various sections, chapters, headings, and sub-headings that belong to alike nature. Want to Stay Ahead in Indirect Tax? Professional Tax Registration. Import Data Export Data Both. However, some countries, especially those with specific trade or taxation requirements, might add additional digits to the HSN Code to create a more detailed classification system. Risk Management and Regulatory Risk. Hong Kong Company Incorporation. Signup Now. Immigration Lawyer. Here are some of our clients:.

Origin Chapter: Chapter

Chapter : 99 All Services. CSR-1 Filing. Finance Agreement. Umbrellas and sun umbrellas, walking sticks, seat sticks, riding crops and parts thereof, and whips. Machinery and Mechanical Appliances, Electrical Equipment and Parts Thereof, Sound Reproducers and Recorders, Television Image and Sound Reproducers and Recorders, and Parts and Accessories of Such Articles Chapter 84 Nuclear reactors, machinery and mechanical appliances, boilers, and parts thereof to Chapter 85 Electrical machinery and equipment and parts thereof, sound reproducers and recorders, television image and sound reproducers and recorders, and parts and accessories of such articles to Section XVII. The tax liability on the shortfall of inward supplies from unregistered person so determined shall be added to his output tax liability in the month not later than the month of June following the end of the financial year. Mandatory Annual Filings. Plastics, Rubber, and Articles Thereof. Professional Tax Registration. Provisional Patent Application. Payroll Maintenance. Legal documentation and certification services concerning patents, copyrights and other intellectual property rights—

Your phrase is matchless... :)

Idea excellent, I support.