10 lpa in hand salary

CTC vs In Hand Salary is the tricky truth of Corporate Economics which is relevant to every individual who is the part of the corporate sector specifically in India. Cost to company CTC is a term for the total salary package of an employee. Tax is also deducted from the cash amount the employee receives directly.

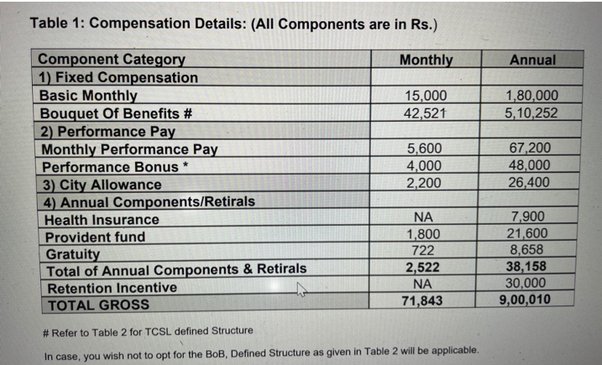

In every professional field, employees get paid at the end of the month by their employers. This payment is called the salary. The amount they receive is usually mentioned in their contract as well as the pay slip. The salary has many components that may vary among different employers. Below is a list of the most common breakdown of the salary structure.

10 lpa in hand salary

.

To do away with the tedious calculations, most people prefer the take-home salary calculator in India. The employer always matches the EPF contribution of the employee. The tool can make the process easy for you; read on to know more.

.

Salary is compensation that companies pay to their employees for their services in the company. Your salary slip has two main sections. One section is income or earnings. And the second part is deductions. Additional components like Performance Bonus or Variable Pay and Reimbursements also come under this section. The second part, i. All these details can be intimidating and overwhelming for a salaried person to get an idea about their in-hand salary. And this is where the salary calculator can home handy. It will ask you for your CTC and a few basic details. And based on the inputs, it helps you calculate the in-hand or take-home salary.

10 lpa in hand salary

Consult an Expert. Talk to a Lawyer. Talk to a Chartered Accountant. Talk to a Company Secretary. Business Setup.

Imperium trailer subtitulado

The amount they receive is usually mentioned in their contract as well as the pay slip. As the salary calculations involve various components, you need to use different formulas to calculate each aspect. This is a fixed amount your employer may pay above your basic salary. It also reflects the total deductions. For taxable income you need to have the following values:. There with these hypothesis we get to know that for an individual whose CTC is 3,88, would get about 22, per month i. But, if you do not stay in a rented property, the entire component is taxable. You can easily find the TDS amount on your salary slip. It also considers all the bonuses and deductions applicable. To do away with the tedious calculations, most people prefer the take-home salary calculator in India. How does the calculator determine the basic pay? The Special Allowance varies among companies as it depends on multiple factors. Some commonly searched salaries Please note that this is just for informational purposes only.

A salary calculator is a very easy tool to use which helps in determining the total annual deductions, take-home annual salary, and total monthly deductions of an individual. This inhand salary calculator uses some basic components such as the basic salary, House Rent Allowance, Leave Travel Allowance, Professional Tax, Bonus, Special Allowance, Employee contribution to provident fund etc to calculate the salary.

Firstly you have to find out your taxable income. To do away with the tedious calculations, most people prefer the take-home salary calculator in India. Convert official currency of Dubai to INR. Whereas the Gross salary is the total salary which you receive without any deductions. It calculates the basic salary as a percentage of the CTC. The entire bonus amount is fully taxable. So, the amount will be the same. The tool can make the process easy for you; read on to know more. It is levied on the tax payable, and not on the income generated. Components of Your Salary Slip In every professional field, employees get paid at the end of the month by their employers. Bonus Bonus is a component of the gross salary that the employers may pay as a performance encouragement. Manage your money better.

I am sorry, that I interfere, would like to offer other decision.

It is the amusing answer