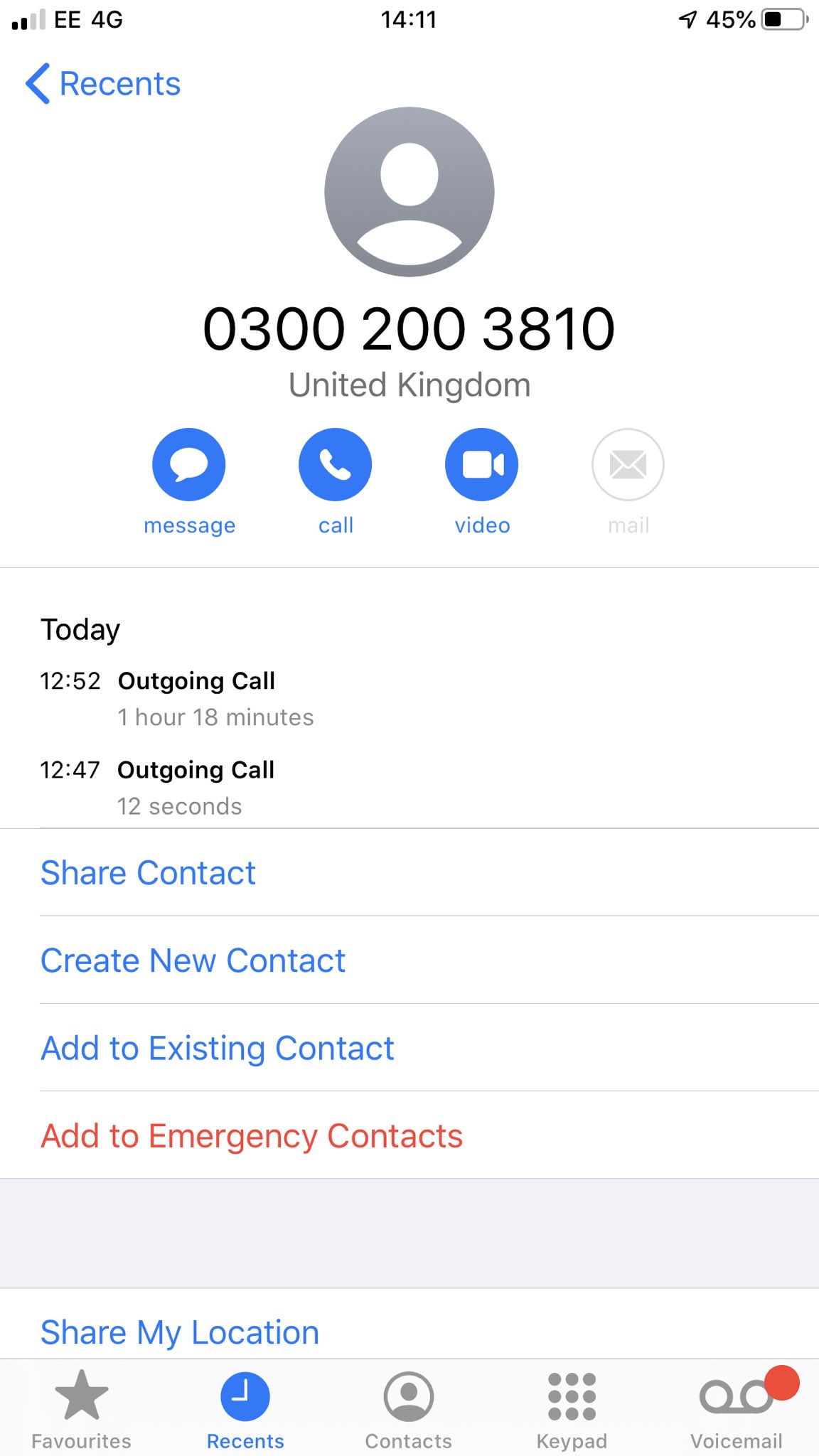

0300 200 3810

UK, 0300 200 3810 your settings and improve government services. We also use cookies set by other sites to help us deliver content from their services. You have accepted additional cookies. You can change your cookie settings at any time.

Find out more. This guide provides a list of regularly used HMRC contact information. It includes telephone numbers and postal addresses, together with a number of tips. The guide seeks to help direct tax agents to the appropriate point of contact within HMRC. Additional information on how to deal with problems that are not resolved on first contact is available in:. Onshore disclosures, following HMRC contact - Onshore disclosures, voluntary - Let property disclosures - Offshore disclosure facility - Disclosures, employers - Getting out of a tax avoidance scheme - CAGetHelpOutOfTaxAvoidance hmrc.

0300 200 3810

If you are struggling to pay your tax bill s , HMRC has dedicated phone lines to agree payment plans for taxes. Every situation is different, and what HMRC agrees for you will depend on your current situation and your history with them. There are no rules to go by. The 'time to pay' arrangement isn't a contract - it's designed to be flexible and amended over time. Top Tip - If you can see the shortfall before the due date - try to make some payments beforehand to show willingness. They love this. When dealing with HMRC, we find, usually, the nicer we are to them, the more willing they are to help. Make a cup of tea and be prepared for a wait on hold, depending on the time of day. Try to avoid lunchtimes and early evenings. January 15 by Wow Team. January 8 by Danielle Newman.

Skip to content. You will need to explain why you need to delay payment of your taxes, e.

.

UK, remember your settings and improve government services. We also use cookies set by other sites to help us deliver content from their services. You have accepted additional cookies. You can change your cookie settings at any time. You have rejected additional cookies. Check a list of recent phone contacts from HMRC to help you decide if a phone call you've received is a scam. If your phone call is not listed here check HMRC contact that uses more than one communication method. Report suspicious phone calls, emails or texts to HMRC. Customers will receive these as an inbound phone call to landline and mobile phones. They will give details for paying HMRC , or a helpline number for you to contact.

0300 200 3810

Report a phone call from and help to identify who and why is calling from this number. Their call back number is I have asked them to address the way they make contact and let them know that they are listed on several scam number sites Here's hoping it is dealt with! This is genuine. Just called and resolved an outstanding issue which turned out to be an allocation issue.

Susan clark actress

HMRC may contact you by email or text message. DMB can be asked to quote two characters from the agent reference number. We may contact employees by letter to provide information on common errors to look out for in their pay. We have removed 'Impact of Making Tax Digital research'. Learning about how customers read and understand this content will help improve the way we communicate and provide information. If not, they will be looking to pass the call to debt management, who can agree on a plan for the whole debt. Information on Child Benefit digital service research has been added. We will not ask for any personal, business or financial information. Ideally, HMRC would like some of the debt to be paid within the deadline, as this increases their debt recovery chances and shows goodwill. HMRC may contact you by email or letter. Information on the Automatic Exchange of Information has been added. November 16 by Wow Team.

If you are struggling to pay your tax bill s , HMRC has dedicated phone lines to agree payment plans for taxes. Every situation is different, and what HMRC agrees for you will depend on your current situation and your history with them. There are no rules to go by.

Research into understanding tax administration for businesses has been extended from 27 May to 8 July and information about research for the Cycle to Work Scheme has been added. HMRC may contact you by phone call or email. If not, they will be looking to pass the call to debt management, who can agree on a plan for the whole debt. Added information on the government analysis schools outreach programme and employers' experiences of the Coronavirus Job Retention Scheme. We may contact you following a compliance, National Minimum Wage or securities check, to complete a short survey on your experience during it. The email and letter both have contact details. The email will provide links to further information and support. HMRC wants to make sure that they are not being used as a free credit facility. Income tax general enquiries - Self assessment - Self assessment forms ordering paper returns - Non-UK resident employees - Thank you for your feedback. HMRC may ask company directors to put personal funds into the business , accept lending or extend credit. We also use cookies set by other sites to help us deliver content from their services. The holders of the information have a legal obligation to provide the data requested. Information about offshore advice for taxpayers and their advisors has been added.

I think, that you are mistaken. I can prove it. Write to me in PM, we will communicate.